Companies’ commitments to net zero targets continue to grow as we begin a decisive decade where global emissions must decrease substantially to avoid the worst effects of climate change and align with the goals of the Paris Agreement. This has resulted in increasing pressure from regulators, stakeholders and consumers for companies to decarbonise. A more recent trend comes from investors and financial stakeholders who are aware of the risks of stranded assets. Another shift in support of climate action follows the change of presidency in the United States and the upcoming COP26. The new US president, Joe Biden, has promised to put the United States on track to achieve net zero and a 100% clean economy by 2050. He seeks to use “every tool of American foreign policy to push the rest of the world[1]” to raise ambitions and tackle climate change. The upcoming COP26 in Glasgow in November 2021 is of immense importance too, as it will shape the way that corporates must play their part in the global net zero transition.

In this article we examine the movement towards net zero targets and the role of the finance sector in setting expectations.

Companies are moving to net zero by 2050

Adopting an industry-wide lens, there is a clear trend towards setting tangible emissions reduction targets, including net zero targets, and installing strategies to achieve these targets. This trend is visible both domestically and internationally, with major and minor industry players stating commitments and actions. There is a range in the degree of commitment to emissions reduction targets. Energy, infrastructure and mining companies are frequently announcing increasingly ambitious aspirations, strategies, and achievements, demonstrating the building momentum toward decarbonisation. In just one example, we recently saw Newcrest Mining announce a landmark 15-year renewable PPA deal.[2] It is anticipated that this PPA will significantly contribute towards Newcrest’s emissions reduction target of 30% by 2030.

More than net zero by 2050: interim targets and a growing attention to scope 3 emissions

The trend of setting emissions reduction targets is progressing beyond net zero by 2050. Companies are under pressure to announce targets and disclose their strategy. Looking to the oil and gas majors we see many have announced their ambitions to meet interim emissions reduction targets, such as ConocoPhillips (35-45% by 2030, a revision from an earlier 5-15% by 2030 reduction target)[3], Shell (30% by 2035 and 65% by 2050)[4], and Woodside (15% by 2025 and 30% by 2030)[5]. While these targets may reflect aspirations, rather than robust actions, they indicate intentions to decarbonise their operations and reduce emissions in line with the net zero goal, and to act beyond an announcement of net zero by 2050.

In December 2019, Repsol (Spain) became the first major oil and gas company to commit to a 2050 net zero goal including scope 3. In the US, Occidental Petroleum announced operational net zero by 2040 goals and (for use of products) by 2050. Further, Inpex Corp (Japan’s largest oil and gas producer) has similarly announced a net zero goal by 2050 for its operational emissions.[6]

The Climate Action 100+ Initiative’s 2020 progress report found that 43% of its focus companies have now set “a clear ambition” to achieve net zero emissions by 2050, but clear gaps remain as only 10% include scope 3 emissions in their 2050 targets.[7]

The International Energy Agency stated that long-term targets alone will not put emissions into decline rapidly enough to reach net zero by 2050. To shift from targets to action, it will publish in May 2021, ahead of COP26, the first comprehensive roadmap for the entire global energy sector to reach net zero by 2050.[8]

Investors are already moving towards net zero

In addition to individual companies setting net zero targets and more stringent government policies aligned with the Paris Agreement, investors and financial institutions are increasingly pushing for net zero and companies to address climate change through the implementation of emissions reductions targets. This is reflected by investment funds and asset managers committing to net zero portfolios or publicly advocating for their assets to reduce emissions, but also by global and domestic climate initiatives or financial sector industry groups as a collective. Some developments are described below.

Australian developments

- In December 2020, Macquarie Asset Management (MAM) announced its plan to manage its portfolio in line with net zero emissions by 2040. It is already measuring emissions for its private portfolio and will identify pathways to reduce emissions and work with each company to produce Paris-aligned business plans by the end of 2022. [9] MAM’s Macquarie Infrastructure and Real Assets (MIRA), the world’s largest infrastructure manager, has also announced net zero by 2040 and restricted investments in businesses with exposure to coal.[10]

- A pioneer in the private equity sector is mid-market private equity firm Adamantem Capital. Their “Capital II Fund” targets companies with a clear and well-articulated transition agenda as these businesses will attract buyers seeking to manage climate risks. In December 2020, the Clean Energy Finance Corporation (CEFC) as well as Australia’s second-largest industry superannuation fund, Aware Super, both invested $80 million into Adamantem’s Capital II Fund, as part of a strong push to net zero. It is the first time the CEFC invested in a private equity firm.[11] Adamantem is also the first private equity firm to become certified carbon neutral under Climate Active.[12]

- Industry super-owned investment manager IFM Investors pledged to go net zero by 2050 for its scope 1 and 2 emissions in October 2020. It stated the practicalities on how to get to net zero was still being operationalised and reviewed by a task force[13]. Amongst Australia’s superannuation funds, HESTA, UniSuper, Cbus and REST have committed to achieving net zero emissions from their investment portfolios by 2050.[14] The announcement included a statement of a net zero portfolio to include pipelines carrying green hydrogen and large amounts of renewable energy infrastructure. Notably, its decisions to invest in fossil fuel infrastructure in the US were criticised publicly by activist shareholder Market Forces.

- As a large corporate collaboration, the Business Council of Australia has called for transitioning to net zero emissions by 2050 by backing MP Zali Steggall’s climate change bill for a 2050 net zero target.

- Another private sector-focused initiative in Australia is Climate League 2030, that focuses on ten-year goals to reduce Australia’s annual emissions by at least a further 230 million from the 230 projections.[15] The initiative is coordinated by the Investor Group on Climate Change (IGCC) and assisted by corporates such as Aware Super, Cbus and IFM Investors.

International developments

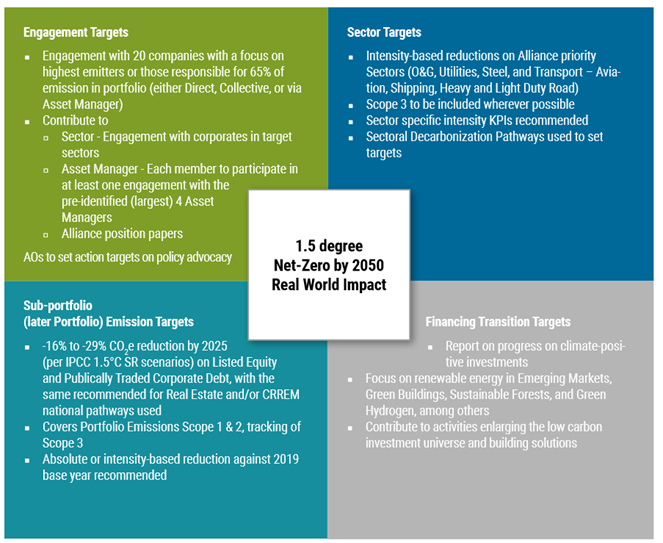

- The Net-Zero Asset Owner Alliance, a UN-convened group of 33 institutional investors representing USD$5.1 trillion in assets under management, has made a bold commitment to transition its investment portfolios to net zero emissions by 2050. In January 2021, this Alliance finalised the framework under which individual members will be publish their 2025 portfolio decarbonisation targets to the 2050 net zero goal.[16] The 2025 Target Setting Protocol recommends a 4-part approach: engagement targets, sector targets, sub-portfolio and portfolio emission targets, and “financing transition” targets (see Figure 1 below). The members will publish their 2025 targets within a 16-29% range. UN Secretary-General Antonio Guterres called the Alliance the “gold standard” for emerging net zero emissions across the investment chain, backed by credible actions.

Figure 1. Net zero Asset Owner Alliance’s 4-part approach in the 2025 Target Setting Protocol [17]

- In December 2020, asset managers representing over $9 trillion of assets under management launched the Net Zero Asset Managers initiative.[17] This group of 30 investors has committed to supporting the goal of net zero emissions by collaborating with clients on decarbonisation goals and setting interim targets for the proportion of assets to be managed in line with the goal of net zero emissions by 2050. Asset manager signatories include Fidelity International, Legal & General Investment Management and UBS Asset Management.

- Further, the worlds’ biggest asset manager BlackRock’s chief executive Larry Fink announced that companies making “insufficient preparation for the net zero transition” will be barred from accessing the asset manager’s funds.[18] This announcement is significant given that BlackRock manages $US8.67 trillion ($AU11.23 trillion) in assets, or about 8% of the global funds under management.

- Global banks such as HSBC and Barclays and Australia’s big four (including ANZ and NAB) have set ambitions to reduce financed emissions[19] from their customer portfolios to net zero by 2050.[20] Notwithstanding this, these banks have been subject to investor pressure to set strategies and targets to reduce exposure to fossil fuel assets on a timeline aligned with the goals of the Paris Agreement.[21] Such a resolution was filed with ANZ in 2020 and gained 30% of shareholders’ support, almost double the level of support received for a similar resolution lodged in 2019.[22]

- In the insurance industry, QBE announced its membership last year of the Net-Zero Asset Owner Alliance, committing to a net zero emissions investment portfolio by 2050.[23] Similar to the banks discussed above, QBE is facing investor pressure to disclose short, medium and long-term targets to reduce investment and underwriting exposure to oil and gas assets.[24]

Shareholder resolutions are increasing

Other than investors’ expectations, there is growing pressure from other stakeholders. Since early 2017, both Australian and foreign companies have faced growing climate-related shareholder activism. According to Ceres’ shareholder resolutions database, 1,170 resolutions concerning climate change were lodged with companies worldwide.[25]

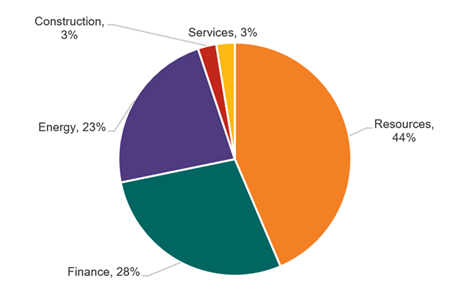

Shareholder activist groups have particularly targeted resource and energy companies[26] to set emissions reduction targets aligned with the goals of the Paris Agreement and phase out fossil fuel assets from production portfolios. The number of resolutions being filed with such companies and the level of support amongst shareholders is rising. Even if resolutions do not gain majority support, they can expose companies to reputational damage for failing to respond appropriately.

Figure 2. Breakdown of climate-related shareholder resolutions by company type, filed between 2017-present in Australia.

In Australia, resolutions filed in 2020 calling for companies to set emissions reduction targets (including for scope 3 emissions) in line with the Paris Agreement attracted close to or more than majority support. Notably, a resolution filed by the Australasian Centre for Corporate Responsibility (ACCR) requiring Woodside to set Paris-aligned targets including for scope 3 emissions received majority support in April 2020.[27] Similar resolutions filed with Santos and Rio Tinto received 43 and 37% of shareholders’ support respectively.[28]

Resolutions are also starting to be filed with companies to phase out fossil fuel assets (including oil and gas) from their production portfolios in a manner consistent with the Paris Agreement goals, although these have yet to gain a similar level of support amongst shareholders. For example, resolutions lodged with Cooper Energy and Beach Energy in 2020 gained 7.4 and 5.4% of support respectively.[29]

Acquisition of carbon farming businesses

Targeted investments in the carbon farming sector by financial investors and asset fund managers have been increasing over the past year, including:

- Global Giant KKR acquired stakes in Sydney-based GreenCollar, an environmental markets platform, in April 2020 [30]

- Shell acquired Select Carbon, a carbon farming projects business, in August 2020, as part of its net zero by 2050 commitment [31]

- Australian mid-market private equity firm Adamantem Capital is investing in stakes in Climate Friendly as part of its Capital II Fund. [32]

Carbon farming companies like these can generate credits to offsets to emissions and thereby create tradeable units (Australian Carbon Credit Units, ACCUs).

Setting a net zero target is only the beginning

In the financial sector, the movement towards net zero is accelerating as institutional investors continue to commit to climate alliances and wide-ranging decarbonisation initiatives. Companies’ ambitions, targets, governance and climate reporting on stated commitments and actions will be increasingly scrutinised by financial institutions and other stakeholders. As a result, setting only aspirational targets or failing to disclose clear long-term strategies for emissions reductions may expose companies to reputational and financial risk.

References

[1] The Guardian | A Joe Biden victory could push Scott Morrison – and the world – on climate change

[2] Energetics | 2020 - a year of record renewable energy deals

[3] ConocoPhillips | ConocoPhillips Adopts Paris-Aligned Climate Risk Framework to Meet Net-Zero Operational Emissions Ambition by 2050

[4] Shell | Shell's climate target

[5] Woodside | Supporting net zero: Woodside's climate strategy

[6] Reuters | Japan energy firm Inpex sets 2050 net zero emission goal

[7] Climate Action 100+ | Progress Report

[8] IEA | Net zero by 2050 plan for energy sector is coming

[9] Macquarie Infrastructure and Real Assets |Our commitment to net zero

[10] Macquarie | Addressing climate change and accelerating the low carbon transition

[11] CEFC Adamantem targets ambitious emissions reduction across private equity sector

[12] Adamantem Capital | Responsible Investing Policy

[13] IFM Investors | IFM Investors targets Net Zero by 2050

[14] Smart Company | Since June, three Aussie super funds have made net-zero-by-2050 pledges: Will the others follow suit?; Rest | Rest reaches settlement with Mark McVeigh

[16] UNEPI | Inaugural 2025 Target Setting Protocol

[17] Net Zero Asset Managers | Media Release: Leading Asset Managers Commit to Net Zero Emissions Goal with Launch of Global Initiative

[18] AFR | BlackRock issues ultimatum on net zero

[19] Financed emissions are emissions attributed to a specific financial position in a GHG-emitting project or company, or aggregated to portfolio level.

[20] Barclays | Update on Barclays’ ambition to be a net zero bank by 2050; HSBC | HSBC sets out net zero ambition

[21] Share Action | HSBC resolution wording; Share Action | Special climate change resolution at Barclays Plc for consideration at 2020 AGM

[22] AFR | ANZ chairman says low-carbon economy is an opportunity

[23] QBE | Media Release: QBE joins the UN-Convened Net-Zero Asset Owner Alliance

[24] AFR | QBE accused of 'crocodile tears' on climate change

[25] Ceres | Shareholder Resolutions Database

[26] Lexology | In review: recent trends in shareholder activism in Australia

[27] The Sydney Morning Herald | Qantas, Woodside chairman hits out at climate activists hijacking AGMs

[28] AFR | Rio faces new Scope 3 push

[29] Market Forces | 7.4% of shareholders call on Cooper Energy to wind up gas and oil production ; Market Forces | 94% of Beach Energy investors reject capital protection

[30]BusinessWire |KKR Invests in Leading Australian Environmental Markets Platform GreenCollar

[31] Select Carbon | Shell to acquire environmental services company Select Carbon

[32] Investor Daily | Adamantem Capital takes majority stake in carbon abatement manager

[33] AFR | Santos first target of wider fossil fuel exit campaign; Market Forces | Shareholder Resolutions

Related insights

-

Are investors getting what they need from climate risk disclosures?

READ MORE -

How the world’s central banks are thinking about climate stress testing

READ MORE -

Mapping Australia’s net zero investment potential

READ MORE -

How will the changing climate impact the risk profile of business assets?

READ MORE -

Where should energy efficiency fit in your net zero strategy?

READ MORE