Originally published on the GRESB website.

Predicting and budgeting for the lifecycle of a commercial building is traditionally viewed as straight forward. Historic data, an understanding of market conditions, good knowledge of how buildings behave and tried and tested facilities management strategies mean budgets for CapEx and OpEx can be fairly accurate. The predictable nature of the built environment has allowed property and portfolio managers to develop static business as usual (BAU) targets, usually derived from a baseline year with a margin of uplift to cover increasing costs. In this article, we consider how relevant business as usual thinking is in a world where climate change presents an uncertain future.

Forecasting challenges

A world impacted by a changing climate is no longer a construct of the imagination. Projections made three decades ago by scientific authorities such as the CSIRO are proving accurate[1]; extreme weather events are increasing in strength and frequency. Areas of Australia are already having to adapt to changing rainfall patterns and longer periods of hotter weather. While long-term projections for global heating vary, most models track closely to 2030.

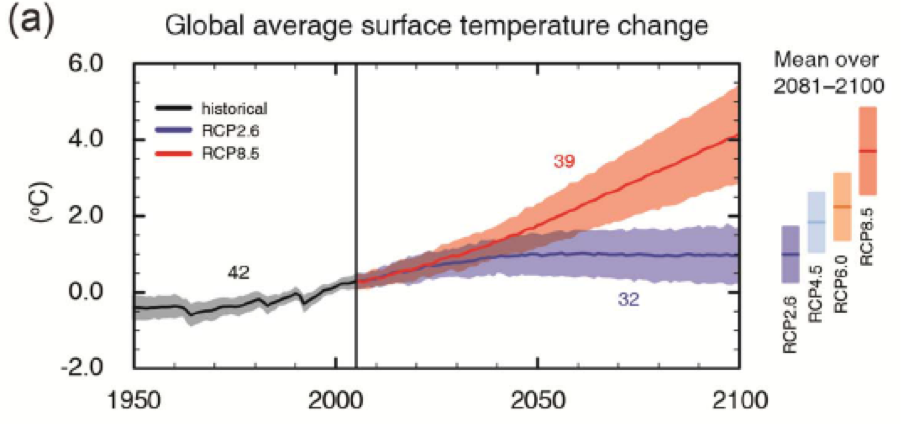

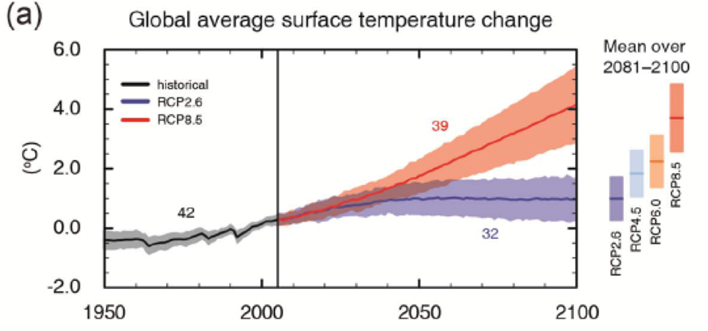

Figure 1: Global warming by 2100: 0.3°C – 1.7°C for low emissions scenario as determined by the Intergovernmental Panel on Climate Change (RCP2.6), and a temperature increase of 2.6 – 4.8°C for high emissions (RCP8.5)

In the management of commercial properties, a BAU budget may take account of escalating energy costs and a moderate increase in consumption. However, an increasing ambient temperature will have a much greater impact on both OpEx and CapEx spends. If we consider the changing cooling demands of a building it becomes apparent very quickly that increasing temperatures complicate both physical systems and financial models.

As the ambient outside temperature rises, the conduction of heat into the building increases. By how much is building specific but the trend is roughly linear.[2]

This heat gain adds load to the cooling system, affecting performance on both the air and water sides. Although the cooling plant may be sized to meet a greater internal load, this often assumes a maximum outside temperature. The increase in ambient temperature makes it harder to dissipate rejected heat, reducing the overall coefficient of performance (COP). Eventually, the cooling plant can no longer meet the demand and the internal temperature of the building will rise.

Although the increase in heat gain through conduction is linear, the cubic relationship between pump and motor speeds and energy consumption, plus a reduction in COP means energy expenditure will spike. Where cooling towers are used, water becomes a risk factor both in terms of cost and security of supply.

Planning for the future

The implications of climate change for costs and planning are considerable. Uncertainty and risk, particularly to profitability, means viewing climate change in terms of mitigation only is a short-sighted approach. Reacting to year on year incremental changes is likely to result in significant capital outlay with little long-term durability. An innovative planning methodology that incorporates climate change into the BAU is needed.

Returning to our cooling plant example; with a relatively simple thermal model, it is possible to predict at what ambient temperature cooling equipment will cease to meet demand. Combined with climate forecasts, we can identify a timeframe and thus plan for capital expenditure to replace obsolete equipment. With ambient temperature identified as a key driver for energy costs, we can also project OpEx for a warming world to inform budget and procurement decision making.

This is just one way we can build the impacts of climate change into future models. There is a danger that without such adaptive forward-thinking, buildings could potentially become untenable. Occupant comfort, and the ability to deliver it cost effectively, will likely become key differentiators in tenant decision making going forward. Without a robust planning methodology that takes account of climate change; risk to return on investment (ROI), unsustainable rents and spiraling services charges are likely unavoidable. Demonstrating a science-based understanding of how assets will perform in a changing climate would give greater confidence to tenants and investors alike.

Portfolio managers need to understand the needs of their tenants and investors, and how climate risk will shift stakeholder priorities. Seeing beyond traditional static markers and shifting to a dynamic business as usual forecast would allow commercial real estate management to shift from reaction to climate action.

Please contact your Energetics account manager if you have any questions.

References

[1] Australian Financial Review | CSIRO saw this summer 30 years ago

[2] To calculate heat loss/gain into/out of a building via conduction through the building fabric, Q = A * U * (T1 – T2) is applied, where U is the thermal transmittance of the material and A is the surface area. For further reference, click here.