Over the last few weeks an enormous uplift in carbon reduction pledges, net zero targets and other climate diplomacy has been seen across the world. The US, after re-joining the Paris Agreement, announced ambitious targets of 50-52% reduction by 2030 and net zero by 2050 (2005 baseline) at its Leaders' Summit on Climate; the EU carbon price rose to over €47 (~AUD$73) per tCO2e in an all-time high; the US and China committed to tackle the climate crisis by strengthening implementation of the Paris Agreement[1]; Japan, Canada and the UK ramped up their emissions reduction targets, and the EU clinched a deal on a landmark Climate Change Law to sit at the heart of its climate policy.

In the same week, the International Energy Agency (IEA) predicted a major surge in global energy demand in its Global Energy Review 2021, an increase which would reverse 80% of the fall seen over 2020. As a result, global emissions would be just 1.2% below 2019 emissions levels.[2] This prediction by the world’s leading energy policy advisor runs contrary to the global climate action trend, and serves as a reminder that targets are only starting points. Governments must act in collaboration with the private sector for global emissions to peak in the upcoming years and thereby actually fulfil their climate change promises.

These developments have created positive momentum in the run up to COP26 in Glasgow later this year. But what does it all mean for Australian businesses? This article provides for an overview of recent climate policy developments and key takeaways for Australian governments and market players.

We start by examining the position of the Australia’s Federal Government and their steadfast refusal to adopt a net zero target.

Australia: no change to targets, not on track to achieve net zero

On the day US President Joe Biden hosted the Earth Day Summit, APRA, Australia's prudential regulator of banks, insurance companies and most superannuation funds, released its Prudential Practice Guide CPG 229 Climate Change Financial Risks (CPG 229), which as stated in its media release, is “designed to assist APRA-regulated entities in managing climate-related risks and opportunities as part of their existing risk management and governance frameworks…The guidance covers APRA’s view of sound practice in areas such as governance, risk management, scenario analysis and disclosure.”[3]

However, addressing climate risk by setting a national net zero target to reduce emissions in line with climate science, was not on the agenda of Prime Minister Scott Morrison when he addressed the Earth Day Summit. The Australian Government resisted pressure to strengthen its current target of a 26 to 28% emissions reduction (baseline 2005). Prime Minister Scott Morrison affirmed it is the Government’s ambition to reach net zero as quickly as possible, and preferably by 2050, yet Australia’s current low level of ambition means that we are poorly placed for reaching net zero. Energetics’ own examination of the Emissions Projection 2020 demonstrates the problems with our current trajectory.

Instead, in the lead up to the climate summit, Scott Morrison announced funding of more than $1 billion for the development of new hydrogen hubs and carbon capture and storage projects[4]. It links back to his commitment of focussing on commercialising low emissions technology across five priority areas:

- clean hydrogen

- low-cost energy storage for solar and wind energy

- ‘green steel’ and aluminium

- soil carbon projects

- carbon capture and storage.

Biden Administration officials have flagged that the United States will challenge countries whose climate change inaction sets the world back, including those that fail to cut their reliance on coal.[5] In February, Biden’s climate envoy John Kerry publicly acknowledged differences between the United States and Australia in tackling the climate crisis. Kerry called for a faster exit from coal, putting pressure on the Australian Government to step up before COP26 begins on 1 November this year. In addition to this political pressure, a number of other international developments are creating discomfort for the Australian Government and our exporting industries.

Carbon tariffs, emissions trading markets and legally binding action

EU Carbon Border Adjustment Mechanism: direct and indirect consequences for Australian business

The European Union’s recently proposed Carbon Border Adjustment Mechanism (CBAM) and its approval by the European Parliament[6] will mean that Australian products imported into the EU become subject to a tariff, to make up for the fact that Australia has no carbon tax implemented. The tax is expected to come into effect in 2023 with more legislative details expected in June 2021. It is anticipated that the tax initially applies to carbon-intensive imports such as chemicals, aluminium, cement and steel, before other products will be subject to the regime. The CBAM is expected to be calculated based on the EU ETS carbon price, to ensure equal treatment of EU and non-EU companies. While the details of this policy remain to be seen and consistency with World Trade Organisation legislation needs to be assured, the introduction of CBAM constitutes punitive international action against laggard countries.

For Australia, our trade of carbon intensive goods to the EU has fallen, especially since the UK left the EU, thereby creating the domestic view that we are unlikely to be heavily impacted by CBAM in the short term. However, amongst Australia’s traded goods to Europe are gold, coal and oil seeds, which all have various environmental impacts and likely to be subject to the regime in the near or medium term. Moreover, the CBAM might have indirect consequences: Australia’s larger trading partners such as China or South Korea may impose a similar measure, a carbon tax scheme at the domestic level may be reconsidered, or companies’ may look to relocate their factories to avoid the tax – all of which would greatly affect Australian business.

Could the US, Australia’s third largest trading partner, impose a carbon border tariff?

As the US announced a new emissions reduction pledge to cut greenhouse gas emissions by 50 per cent to 52 per cent by 2030, the US special envoy on climate, John Kerry, added a warning to climate laggards that failure to curb emissions could result in the US taxing exports. He stated, “President Biden, I know, is particularly interested in evaluating the border adjustment mechanism.” President Biden himself stated that he would ensure that American industry would not face “an unfair competitive disadvantage” as a result of its more aggressive climate action.[7]

EU Climate Law: a precedent for legally binding climate action

As one of the key elements of the European Green Deal, on 21 April 2021 the European Council and Parliament agreed on the European Climate Law, committing the EU to reach climate neutrality by 2050 and an interim target of a reduction of emissions by at least 55% by 2030, including an aspirational goal of achieving negative emissions after 2050.[8] With the European Climate Law, Brussels proposes a legally binding target of net zero by 2050 (1990 baseline) to the EU institutions and its Member States.

The law requires the EU to create an independent body of scientific experts to advise on climate policies, as well as a greenhouse gas budget laying out the total emissions the EU can produce from 2030-2050.

EU Emissions Trading Scheme

The European Union’s ETS covers about 45% of the EU’s emissions and around 12,000 installations, including power generation, heavy industry and aviation. In its third phase (2013-2020), the ETS accounted for 45% of all GHG emissions in covered countries.[9] The ETS is a market-based mechanism based on the principle of ‘polluters pays’.

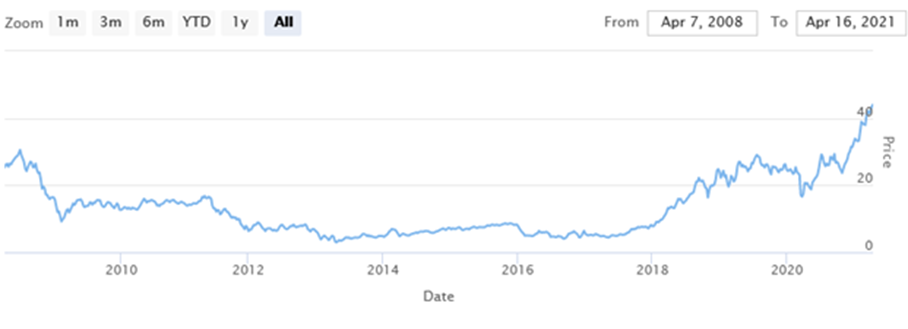

The EU ETS is the world’s biggest carbon market. Analysts project that the EU carbon price could more than double in the coming years.[10] The EU carbon price recently rose to an all-time high to over €40 (~AUD $60), as shown in Figure 1 below. The recent spike can be explained by market speculations as a result of the expected revision of the EU Emissions Trading System in June 2021, the stricter emissions reduction target of 55% below 1990 levels by 2030, as well as the recent announcement of CBAM.[11] A stronger reduction target will mean stricter annual carbon caps and as expected, the inclusion of emissions from the shipping industry. Cost increases due to ETS allowance price rises in the past were to a large extent passed through to consumer prices, especially by energy-intensive industries such as iron, steel and oil.[12]

Figure 1. EU carbon price as of 16 April 2021.[13]

Emergence of other emissions trading markets

At the international level, carbon markets are in constant development and drive the demand for offsets. The procurement of international offsets is therefore subject to many uncertainties resulting from various countries climate inaction and policy changes. As the number of emissions trading schemes increases worldwide, the interest in linking these schemes grows as a means of reducing environmental compliance costs, expanding market size and transparency and reducing carbon price volatility.

UK ETS

As a result of Brexit, the United Kingdom will replace the EU ETS with its own emissions trading scheme in May 2021.[14] It is looking like the scheme will be very similar to the EU ETS, though the UK has stated that it will be more ambitious. It is based on the same principle of a cap on emissions decreasing over time, and freely tradeable emissions allowances. Industries covered are power generation, heavy industry and aviation. The floor price is set to start at £15 per tCO2e. Linking the UK ETS and EU ETS is under review.

China’s ETS

As part of its recent commitment to net zero emissions by 2060 (and 65% by 2030 compared to 2005 level), China’s carbon market went live on 1 February 2021 and trading is targeted to commence by June 2021. All entities that emit more than 26 tCO2e per annum since 2013 would be covered by the scheme.[15] With a coverage of 2,255 power companies and an estimated 4 billion tCO2e per annum, it is expected to become the world’s largest carbon market.

Other regional carbon markets

Smaller markets are growing and may impact Australia’s exports and increase the political pressure on the Federal Government.

South Korea, Australia’s fourth largest trade partner[16] commenced its carbon market in 2015 and it grew significantly over 2019 and 2020.[17] The South Korean government recently announced its net zero strategy, including an extension of the Korean ETS to cover the transport and construction sectors in 2021, bringing the scheme’s coverage to 73.5% of its economy.

The New Zealand ETS, with broad sectoral coverage, was implemented in 2008. Its carbon price reached NZD $40 in early February 2021, but has lowered since. In 2020 the New Zealand government strengthened its ETS and it is expected to announce a revised NDC soon.[18] Germany launched its National Emissions Trading System for heating and transport fuels in 2021, complementing the EU ETS and will be phased in gradually with a fixed carbon price from 2021 to 2025.[19] New Zealand also recently introduced a Bill requiring companies in the financial sector to disclose the impacts of climate change on their businesses, in a world first.

Regional carbon markets in the US are the Western Climate Initiative (WCI) and Regional Greenhouse Gas Initiative (RGGI). Prices in these markets increased in late 2020 as a result of policy changes under the new Biden administration.[20]

Watch developments in the global financial sector

As described in Energetics’ Net zero commitments: what role are investors playing?, the corporate low carbon movement has made a major shift to the finance sector, with investors and asset managers aiming for net zero portfolios. In other recent developments relating to the finance sector, a large, UN-backed umbrella group of banks, investors, asset manager and insurance companies launched on 22 April 2021 to boost private clean-tech finance and press polluting industries that use their services to cut emissions.[21] The Glasgow Financial Alliance for Net Zero (GFANZ) is the broadest financial industry initiative yet on climate action, with the alliance’s 160+ members responsible for over $70 trillion in assets. Participants include Barclays, Citigroup, Morgan Stanley, Citigroup and HSBC. GFANZ will provide strategic coordination across the financial sector to accelerate the transition to a low carbon economy, but more importantly, signatories must set science-aligned interim and long-term targets[22] for achieving net zero emissions by 2050. Banks will specifically focus on high-emissions industries, such as oil and gas, aluminium, steel, cement and power generation.

More nation state commitments ahead of COP26

Lastly, countries’ recent actions on climate change have set the ambition level and enthusiasm for COP26 high. Arguably the most important outcome of the Glasgow Conference will lie in Article 6 of the Paris Agreement: the architecture and accounting for international carbon trading. The stringency of these rules will strongly influence countries’ appetites to establish multilateral carbon credit trading schemes. Linking the proposed CBAM to the EU carbon price under the ETS could suggest a starting point for commencement of international linkage. This relates, but is not limited, to agreements on Nationally Determined Contributions (NDCs), carbon accounting and various schemes for implementing the voluntary cooperation that member states will engage in. Flexibility in both import and export of carbon credits would shake up the global carbon market and have an immense impact on the demand and supply of offsets, resulting in extreme price volatility.

More pressure to come. How should Australian businesses respond?

Business is increasingly aware of the economic upsides of seizing low carbon opportunities, with companies setting net zero targets and improving disclosure. The week of climate diplomacy has shown, more than ever, that the international pressure on Canberra is high, and decarbonisation policy changes could come quickly, and possibly before the next election[23].

Whether your business could be directly impacted by measures such as a border carbon tariff or indirectly by the signalling effect of major global players which as the US and UK announcing aggressive emissions targets (particularly businesses which are headquartered in the US or UK), you need to not only follow developments closely, but also examine your own pathway to decarbonisation. With global action increasing, business should look to the momentum being built and similarly increase the level of ambition. Net zero targets should be set with interim targets, supported by clearly defined strategies and plans for capital allocation. Such climate risk responses should in turn be disclosed in keeping with the guidance of the taskforce on climate-related financial disclosures, as described in the new APRA Prudential Practice Guide.

References

[1] US Department of State | U.S.-China Joint Statement Addressing the Climate Crisis

[2] International Energy Agency | Global Energy Review 2021

[3] APRA | APRA releases guidance on managing the financial risks of climate change

[4] ABC News | Scott Morrison to spend extra $539 million on new 'clean' energy projects. But will they reduce emissions?

[5] The Guardian | Secretary of state says countries investing in new coal ‘will hear from US’

[6] European Parliament | Towards a WTO-compatible EU carbon border adjustment mechanism

[7] Australian Financial Review | US takes tougher line on carbon border tax

[8] European Commission, EU climate action and the European Green Deal | European Climate Law

[9] Vivid Economics | Market stability measures, design, operation and implications for the linking of emissions trading systems

[10] S&P Global Platts | Analysts see EU carbon prices at Eur56-Eur89/mt by 2030; Bloomberg Green | The EU carbon market is about to enter its turbulent 20s

[11] Another factor explaining the recent spike is the higher energy and equity prices in European winter.

[12] See example Martin, R. and others, “The Impact of the European Union Emissions Trading Scheme on Regulated Firms: What Is the Evidence after Ten Years?”, Review of Environmental Economics and Policy, 2016, and Marcantonini, C. and others, “Free allowance allocation in the EU ETS”, Policy Briefs, 2017/02, Florence School of Regulation, Energy, Climate.

[13] Ember | Daily EU ETS carbon market price (Euros)

[14] Gov.UK: Guidance | Participating in the UK Emissions Trading Scheme (UK ETS)

[15] The Economist | Can China’s new carbon market take off?

[16] Department of Foreign Affairs and Trade | Australia’s Trade Statistics at a Glance

[17] International Carbon Action Partnership | Korea Emissions Trading Scheme

[18] International Carbon Action Partnership | New Zealand Emissions Trading Scheme

[19] International Carbon Action Partnership | German National Emissions Trading System

[20] Refinitiv Carbon Research | Review of Carbon Markets: 2020

[21] UN Environment Program Finance Initiative | Net Zero Banking Alliance

[22] Energetics | What are the differences between net zero and science based emissions reduction targets?

[23] See Energetics | An examination of the 2020 emissions projection for more insights into key areas of climate and energy policy that may be subject to change.