The expectation for organisations to disclose climate and broader sustainability strategies and performance to their investors has stepped up in significance following the December 2016 release of the Financial Stability Board’s (FSB) recommendations on climate risk disclosure.

The FSB release reinforces the value of existing disclosure efforts. For Energetics’ commercial property clients, our experience is that GRESB – the Global Real Estate Sustainability Benchmark - is a key priority. GRESB is driven by an active group of institutional investors who are seeking evidence of continuous improvement across their portfolios and are ‘demanding tangible improvements in operational performance metrics, such as energy intensity and water consumption’1. Even for those Australian property companies who are leading the global GRESB index, investors are seeking improvements in GRESB performance year on year.

GRESB benchmarks the sustainability performance of Real Estate and Infrastructure assets, as well as Real Estate debt, which captures the ‘current state of ESG (Environmental, Social and Governance) in lending practices as informed by leading primary lenders and private equity investment management firms’2.

In this article we consider the value of GRESB beyond its function as a reporting framework.

GRESB as a driver of strategy

It goes without saying that companies develop sustainability and climate change strategies in response to their own material risks and commercial requirements. Institutional investors with high expectations around sustainability performance create an additional imperative to craft a strategy that, whilst genuinely mitigating risks, also complements the GRESB survey questions and corresponding score weightings.

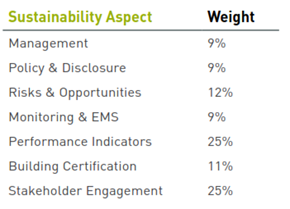

The GRESB score weightings for sustainability aspects within the 2016 Real Estate survey are presented below. As demonstrated, the Performance Indicator and Stakeholder Engagement sections comprise 50% of the total score.

Table 1: GRESB score weightings for sustainability aspects within the 2016 Real Estate survey

Strategies that reporters could undertake to maximise scoring under these sustainability aspects, in turn meeting the demands of priority stakeholders, are discussed further below.

Performance indicators

Much of Energetics’ work with our Real Estate clients relates to collecting robust, granular datasets to inform the performance indicator question sets. Disclosure of energy, water and waste data for own use as well as tenants, is a key point of difference between GRESB and other reporting initiatives. Equally, it can be a point of pain due to difficulties with sourcing data.

Examples of initiatives that could improve scoring include:

- Continuous improvement processes for ensuring the completeness of data collected for both own use, that of tenants and indirectly managed assets

- Establishing long term targets for the management of energy, emissions, water and waste diversion. The implementation of a Science Based Targets, as announced by Investa in late 2016, is highly compatible with this section of the survey

- Onsite solar or offsite renewable energy procurement, which also complements RET exposure for large electricity consumers.

Stakeholder engagement

The GRESB survey also focuses on employee, tenant, supply chain and community engagement strategies deployed.

In Australia, effective tenant engagement strategies represent a significant opportunity for the property sector, especially given the problem of split incentives whereby property owners see little direct benefit in pursuing costly efficiency upgrades which primarily serve only to lower costs for tenants. The split incentive is a sector-wide challenge from top tier REITS, mid-tier institutional investors to private investors3. Furthermore, given that commercial buildings and infrastructure developments have been identified as a major source of abatement in the achievement of Australia’s emissions reduction targets through to 2030 and beyond, efforts to engage stakeholders to overcome barriers to efficiency improvements will become increasingly important.

Conclusion

GRESB has just circulated its pre-release of the 2017 Real Assessment Survey. For those who report to GRESB, consider the broader value it can bring to your energy and carbon management strategy, especially if you are currently engaged in business planning. There would also be value in evaluating GRESB in light of the FSB recommendations.

Energetics has not only advised reporters to GRESB, throughout our broader consulting work we also provide technical support on emissions reductions strategies and projects to governments and large, complex businesses in the ASX200. We can assist with your strategy, assess risks and opportunities and advise on the establishment of systems and processes that support the efficient delivery of accurate reports that enhance your brand and reputation.

References

[1] GRESB | 2016 GRESB Snapshot – Australia/NZ

[2] GRESB | 2016 GRESB Real Estate Debt Snapshot

[3] Finding from Energetics' review of the NSW EUA policy