Today Australia’s Treasurer introduced the long awaited mandatory climate-related disclosure legislation into parliament.

With the first of Energetics’ two Climate-related Financial Reporting Readiness Assessments having been live and widely available for over a month, in this article we share some early insights into the state of Australian business’ preparations for mandatory reporting.

For what is required for calendar year 2025 onwards, 76% of responders are ready

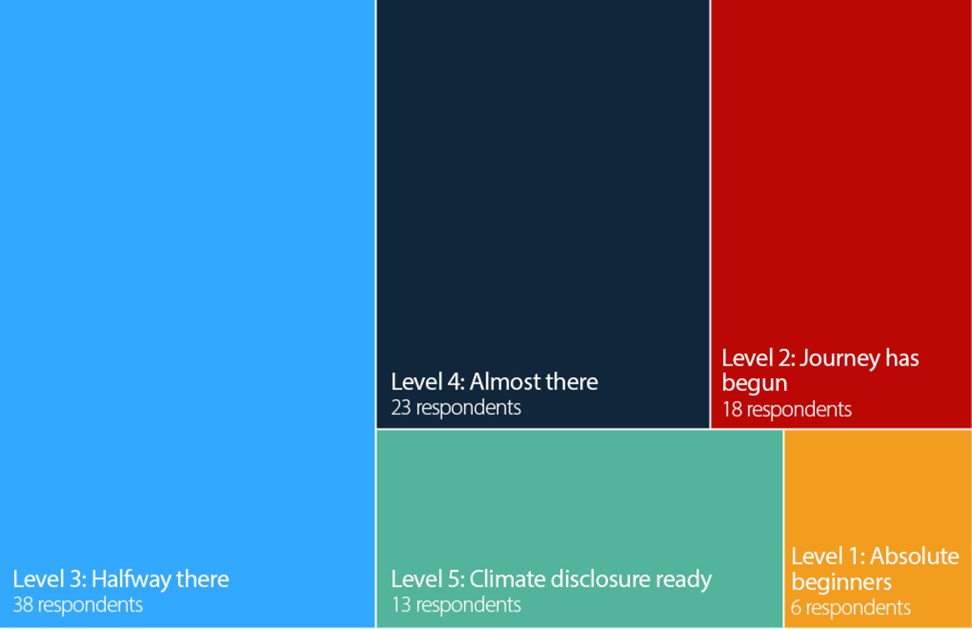

Addressing the elements of governance, risk, targets and metrics, and strategy, companies taking the Assessment have the opportunity to see where the total of their efforts to date sit on a reporting maturity curve according to five levels of readiness. Across the 98 surveys analysed, the average result was 3.2, across the 5 levels on Energetics’ maturity curve. The breakdown of readiness results for the 98 reporters can be seen in the figure below.

The survey has been designed so that an achievement of 3 means that you are likely to be ready to report for the FY24/25 with the understanding that there will be limited assurance of scope 3, transition plans, and physical risk disclosures.

Figure 1: Breakdown of respondents’ mandatory reporting (ASRS) readiness levels

This result indicates that 76% of the companies taking the survey are ready to report.

Of the 98 companies, 51 (52%) are NGER reporters. The average readiness level of NGER reporters is 3.7, whilst the average readiness of non-NGER reporters is 2.7, on Energetics maturity curve. Companies that report to NGER are well placed to report in line with initial ASRS requirements.

How did respondents perform across the four themes of the ASRS reporting framework: governance, risk management, metrics and targets, and strategy?

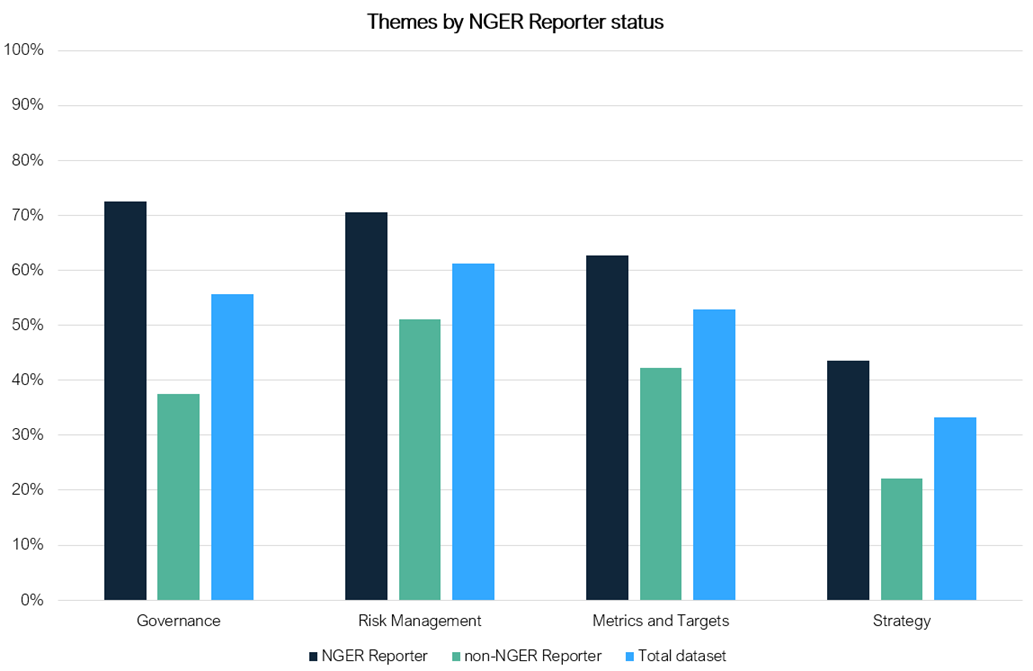

In the figure below we map the readiness of the entire dataset across these four themes. This demonstrates that just more than 60% of the survey respondents are able to address the risk management aspects of the ASRS requirements; more than 50% of the dataset can adequately meet their governance and metrics and targets requirements. Strategy items are not well addressed. When the NGER/non-NGER reporting responses are mapped to these themes we see that the NGER reporters are well-placed to meet their risk management and governance requirements. Metrics and targets as adequately addressed, and strategy elements require work. The non-NGER reporters are not well placed across any of the themes of the ASRS framework.

Figure 2: Breakdown of respondent’s readiness by NGER reporter status

The companies self-declared which ASRS group they fall into. The readiness to report across the survey cohort is interesting.

|

ASRS cohort |

Number of respondents |

% of respondents |

Average readiness score |

|

Group 1 – 1 July 2024 |

47 |

48% |

3.4 |

|

Group 2 – 1 July 2026 |

14 |

14% |

3.3 |

|

Group 3 – 1 July 2027 |

15 |

15% |

2.5 |

|

Unsure/not declared |

22 |

22% |

3.2 |

Table 1: Readiness across groups

This shows that Group 1 and even Group 2 companies are well placed to report. The ‘Unsure Group’ is an interesting result. Additional information is required of respondents to unpack this outcome.

Insights into readiness across sectors

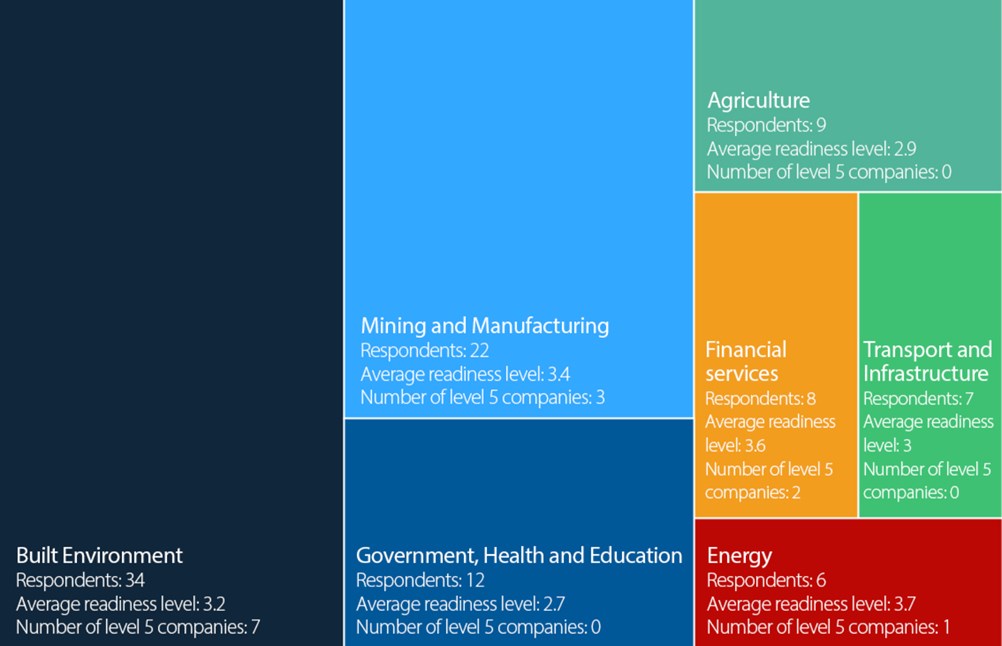

The readiness of different sectors can also be inferred. This table shows that the energy, financial services, mining and built environment sectors are more likely to be ready to report. The results for agriculture and the extended government sector are not surprising as they have not been captured by mandatory programs previously.

Figure 3: Readiness levels across sectors

The number of companies at Level 5 achievement is included in this table. This is a proxy that shows that the results for the Built Environment sector are most dispersed across the range of achievement of 1 to 5.

Readiness across the different aspects businesses will need to report

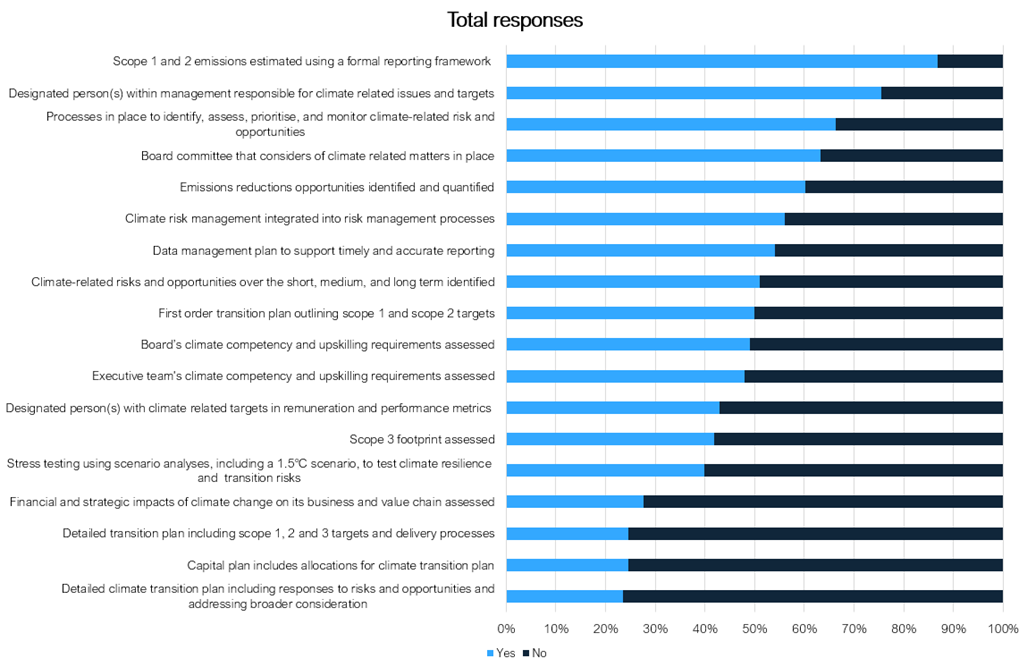

Figure 4 below illustrates the results for the entire data set. This shows that, in the main, companies are doing well with respect to:

- Estimation of scope 1 and scope 2 emissions

- Identifying a person responsible for climate outcomes.

In general companies have:

- Identified someone to have carriage of their climate related work

- Established a board committee to oversee climate risk in the company, and

- Identified emissions reductions opportunities.

Across the data set attention needs to be paid to:

- Scope 3 emissions reporting, and

- Linking the performance of individuals to climate outcomes.

The biggest gaps with respect to meeting mandatory reporting requirements are:

- Stress testing the business strategy relative to different climate scenarios to test climate resilience and transition risks and opportunities

- Assessing the financial and strategic impacts of climate change on its business and value chain

- Developing a detailed transition plan including scope 1, 2 and 3 targets and delivery processes

- Integrating allocations for climate transition into the capital plan.

Where do the biggest gaps lie?

It is unsurprising that the lowest scoring question related to having a detailed climate transition plan[1] including responses to risks and opportunities and addressing broader considerations of the Just Transition.

Figure 4: Results for entire data set

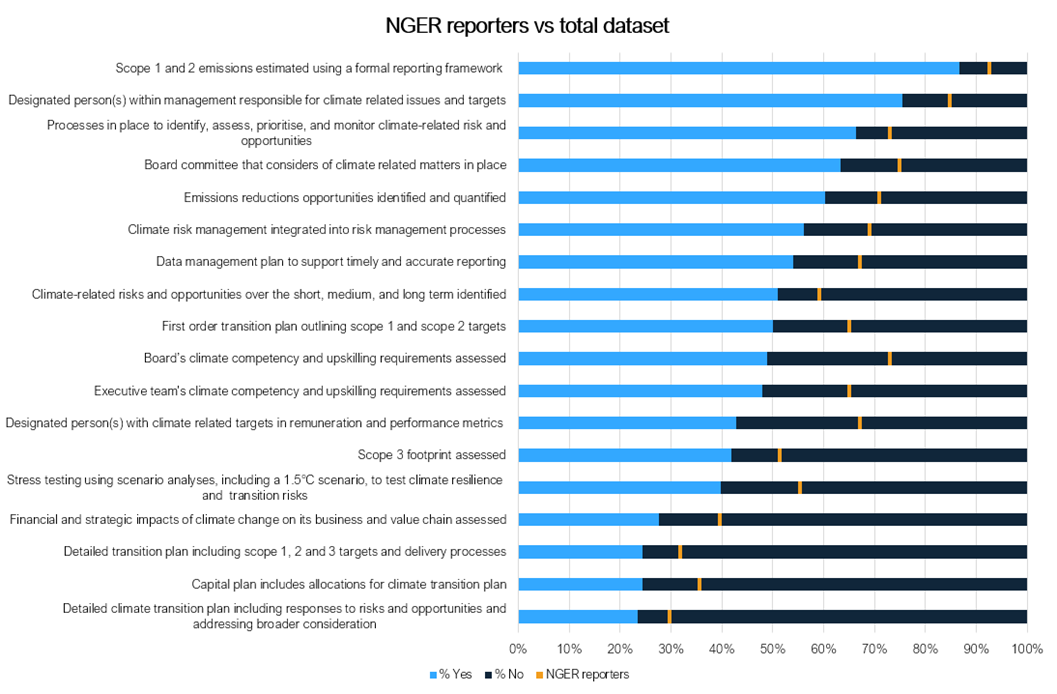

Figure 5 below maps the average of NGER reporter responses onto the total data set. We see that NGER reporters are better placed across all survey areas. Stand out areas of difference relate to governance aspects as well as the identification of emissions reductions opportunities.

Figure 5: NGER reporter assessment responses

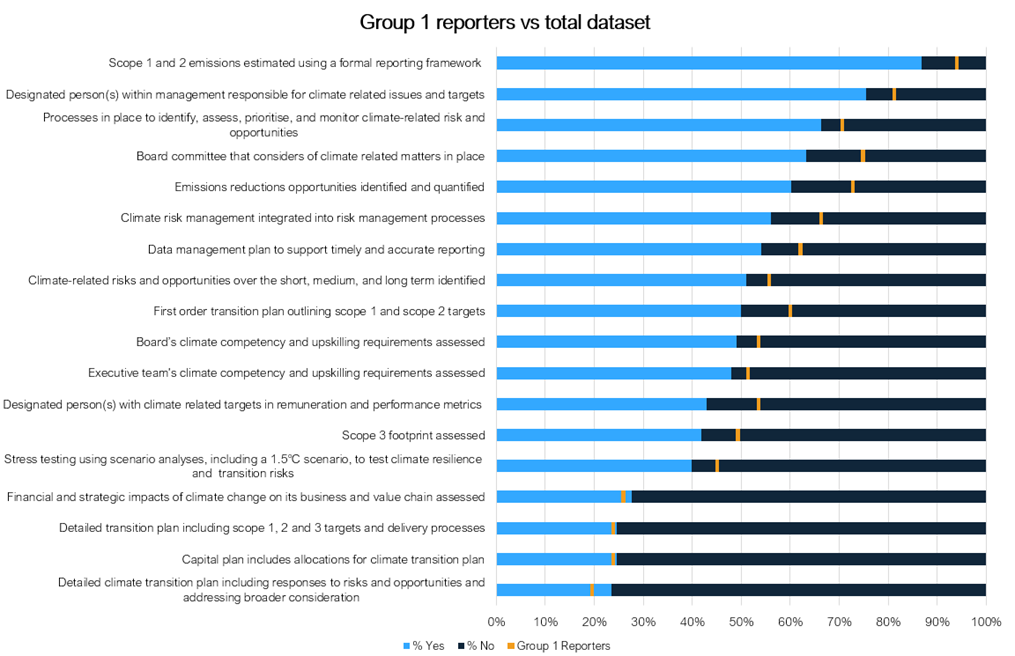

A similar result is seen for the Group 1 Reporters as illustrated in Figure 6 below. However, Group 1 reports are not as far ahead of the average as the NGER reporters are – surprisingly; they are actually behind the average with respect to transition planning.

Figure 6: Group 1 respondents assessment responses

The figure above shows that only in the areas of preparing emissions inventories, having a board committee in place, and assessing emissions reduction opportunities do the Group 1 reporters marginally outperform the NGER reporters.

The result for preparing emissions inventories will need to be unpacked in detail with respondents and may relate to assets held outside Australia to which the NGER regulations did not apply.

Questions, comments? Please get in touch

Whether a client or not, we’d love to hear your views on the results to date. The more we hear from reporting professionals preparing for the incoming mandatory scheme, the more complete the analysis and the insights we can share back to the market. Get in touch with your Energetics’ contact or simply email us via the link in the call-out box below. If you haven’t taken our readiness assessments yet, you can do so here.

[1] Noting a climate transition plan demonstrates to capital markets and stakeholders that an organisation is committed to achieving a 1.5oC pathway, and that its business model will remain relevant (profitable) in a net-zero carbon economy. As noted by CDP, “Very few companies currently have a credible climate transition plan in place”.

Related insights

-

Mandatory climate disclosures | FS Sustainability Climate in focus for business in 2024READ MORE -

2024: Themes, priorities and areas of focus With the pace of climate change increasing, what will be asked of business in 20…READ MORE -

Mandatory climate disclosures | ISSB Preparing for mandatory climate disclosures: Closing the capability gapREAD MORE