On 13 March, 2024[1] The Australian Financial Review featured the findings of a new report from the Clean Energy Council assessing the progress of Australia’s clean energy transition. The article states, “Investment in new large-scale renewable energy capacity fell by almost 80% last year as grid bottlenecks, slow planning and environmental approvals, higher costs and tight labour markets took a heavy toll on Australia’s chances of reaching 2030 climate targets”.

Reaching the 82% national renewable electricity target by 2030 is vital to the achievement of Australia’s 2030 emissions reduction target of 43% on 2005 levels. Also key is realising additional abatement through reforms to the Safeguard Mechanism (SGM).

The Clean Energy Council (CEC) is but the latest group to express concerns that Australia was not on track to reach its 82% renewable energy target. Industry spokespeople from former Snowy Hydro chief executive Paul Broad, to former chairwoman of the Energy Security Board, Dr Schott, Engie Australia boss Rik De Buyserie, and Origin Energy’s Frank Calabria have spoken to the enormity of the undertaking – a challenge compounded by lagging approvals for large projects, including transmission, and the lack of skilled labour[2]. Further, Australia’s largest industry super funds have warned federal and state governments[3] that they were increasingly drawn to invest in countries such as the United States, EU, UK, Japan, and Korea which offer large returns because of policies providing generous tax breaks and committing to significant infrastructure spending. The most dominant global policy, the US’ Inflation Reduction Act, has acted like a magnet globally drawing capital, technologies, resources, and skilled workers because it provides AU$520 billion worth of programs and funding to accelerate the transition to net zero[4].

To address the Australian renewable energy shortfall, in late November 2023 the federal government announced a fivefold expansion of its Capacity Investment Scheme (CIS). The CIS seeks to incentivise new investment in renewable energy generation backed by storage technologies such as batteries or pumped hydro. To deal with regulatory bottlenecks, the Scheme has incentives for states and territories which streamline approval processes to gain a larger share of the capacity auctions that take place every 6 months [5].

In the recent CEC report, CEO Kane Thornton noted that the government’s expanded CIS should “reverse the trend” of under investment in new renewable generation capacity.

However, the CIS cannot address the problem of sufficient transmission.

Energetics own analysis[6] comes to two conclusions. Despite the CIS, the 82% national renewable energy target remains elusive, and the SGM requires extensive use of offsets if it is to deliver the anticipated reductions in emissions.

Australia will struggle to achieve a 43% reduction in emissions by 2030.

In this paper we summarise some of the issues and provide advice to businesses on the implications and steps they can take to mitigate the risks of any policy shifts.

A top-down view of the challenge

In the period from 2012 to 2022, Australia’s annual emissions fell by 94Mt CO2-e per year, a reduction of 16%. Two thirds of the reduction in emissions came from land use changes (LULUCF), with most of the remainder coming from decarbonisation of electricity. Emissions from stationary energy rose by 16Mt CO2-e per year over the period. The average rate of emissions reduction was 9.4Mt CO2-e per year. This needs to increase to at least 17 Mt CO2-e per year, on average, for the next eight years to 2030. The start has not been good, with Australia’s emissions falling by only 3.1Mt CO2-e from 2021 to 2022, and then rising by 3.6Mt CO2-e from 2022 to 2023. The latter was driven by rising emissions associated with transport.

The Australian Government hopes that the electricity sector can deliver to an average emissions reduction of 11Mt CO2‑e per year, a 160% uplift on the annual reduction observed for the past decade.

The Government also hopes that the Safeguard Mechanism reforms can make a significant contribution to the necessary decarbonisation. Our analysis explains why this policy is likely to fall short of expectations.

Delays in Australia’s “herculean[7]” task of transitioning to renewable energy – but can the Safeguard Mechanism bridge the gap?

Achieving the 82% renewables penetration requires a significant increase in the rate of decarbonisation of the power system. The headwinds seen in the sector3 in its quest for additional wind and solar PV generation include:

- Uncertainty around the closure of coal-fired power stations

- Slowing investment in renewable generation

- Delays to key additions to transmission infrastructure

- Community opposition to new wind farms and transmission lines

- Long-term storage projects are unlikely to be completed in time

- Rising costs of renewable generation.

The barriers listed above are of a scale to make it highly unlikely Australia will achieve the 82% renewable energy penetration. Predicting how far short of the 82% we will be in 2030 is difficult.

The changes to the Safeguard Mechanism (SGM) have the potential to deliver some additional abatement but not enough to compensate for the shortfall from the electricity sector. Abatement technologies such as electrification of LNG train compressors, electrification of materials movement in mining operations and mechanical vapour recompression in alumina refineries offer significant reductions in emissions. However, projects of this scale can take several years to implement, which will limit their potential impact in the period to 2030. In the absence of on-site opportunities, the SGM covered facilities will be forced to acquire and surrender carbon offsets - Australian Carbon Credit Units (ACCUs). This is not a desirable outcome as the bulk of these offsets will be derived from biosequestration projects, and sequestration is not a long-term option for carbon removal – there are constraints on the quantity of historical and current emissions that can be stored in biomass and uncertainties in the science. Further, reforestation and afforestation for reasons of carbon removal constrains future use of the land for other purposes. Finally, there is a five-year delay between planting trees and realising significant carbon sequestration due to the growth profile of trees.

The Powering Australia Plan[8] included several measures aimed at reducing emissions due to transport but these are unlikely to have sufficient impact before 2030 to contribute much to closing the gap to the 43% target.

The shortfall

Energetics estimates[9] that annual emissions from the electricity sector will likely fall by between 64Mt CO2-e and 93Mt CO2-e from now to 2030. This estimate was based on projections of recent year trends in emissions from the sector coupled with considerations of likely increases in the rate of decarbonisation. The emissions reduction target required emissions from the electricity sector to decrease by 110Mt CO2-e.

The likely outcome is that Australia will fall short by between 17Mt CO2-e and 46Mt CO2-e.

Emissions per unit of output for SGM covered entities have been falling in recent years, and changes to the SGM will accelerate this trend. The challenge of getting disruptive, emissions reduction technologies implemented prior to 2030 will, however, limit the extent of the uplift in the reduction of emissions per unit output.

Because of these challenges we concluded that emissions from the SGM covered entities will fall in the order of 14Mt CO2-e per year, compared to Government expectations of 46Mt CO2-e. This leaves a shortfall of around 31Mt CO2-e of emissions reduction.

Covered facilities will need to surrender offsets to make-up for shortfalls in abatement delivered through on-site activities. Extensive use of ACCUs to realise a short term target is challenging unless we are confident that there will always be a plentiful source of ACCUs to offset the hard-to-abate sectors in the years approaching 2050.

In all, Australia may need to find anything up to an additional 80Mt CO2-e of abatement to meet the 2030 emissions reduction target of a 43% reduction in emissions relative to 2005.

How businesses can minimise the impacts of any policy shifts

Unfortunately, several of the constraints to emissions reduction in the period to 2030 are beyond the control of the Australian Government to influence in the short to medium term. Such issues include the (significant) shortfalls in the necessary workforce, project deployment times (outside of regulatory requirements that governments can influence) and global material shortages.

However, there are actions that governments in Australia can take. They include:

- directing Australian based resources to increase the renewable content of electricity, which would have the effect of increasing the price of electricity[10]

- expanding the SGM, which would increase the demand for offsets.

There are actions that businesses can take now to reduce the potential impact of either policy measure. These are discussed below.

The first (or is that the forgotten) fuel

The IEA begins its 2022 report into the status of energy efficiency with the following quote in the Abstract:

This year record-high consumer energy bills and securing reliable access to supply are urgent political and economic imperatives for almost all governments. In response to the energy crisis countries are prioritising energy efficiency action due to its ability to simultaneously meet affordability, supply security and climate goals[11].

The IEA sees accelerated action on energy efficiency and related avoided energy demand measures can reduce final energy demand by around 5% in 2030 while the global economy grows by 40%. This corresponds to an annual 5.6% improvement in economy wide energy productivity. Stated policies will result in a 2.4% annual improvement in energy productivity. So, the IEA believes that a doubling in the improvement of energy productivity is possible. The question is where best to direct effort. Figure 1, from the IEA, provides some direction. It shows that the largest emissions reductions will come from improving the energy performance of transport i.e., electric vehicles and improvements in fuel efficiency for remaining petroleum powered vehicles.

Figure 1: Emissions reduction by efficiency-related mitigation measures in the IEA's Net Zero Scenario 2020-2030[12]

Significant savings can also be delivered by improvements to the energy performance of industry. But in the IEA’s latest report into the status of energy efficiency, the IEA reported disappointing progress with respect to energy efficiency improvements in industry. The IEA noted that industrial demand is pushing global energy consumption higher as intensity progress slows. This is certainly the case in Australia.

The other avoided energy demand shown in Figure 1 comes from measures such as digitalisation for example smart controls and the application of data science and AI, material efficiency including the increased recycling of plastics and scrap steel and fuel switching as evidenced by electrification of process heating[13]. These technologies are available today, and unlike the “big bang” measures such as electrification of LNG trains discussed earlier are much easier to implement. Many industrial processes involve chemical reactions and high-temperature heat that cannot be fully decarbonised with current commercially available technology. The IEA reports that around 60% of heavy industry emission reductions by 2050 come from technologies that have been proven to work but are not currently market ready[14]. However, many of the measures based on digitisation, material efficiency and fuel switching can be implemented immediately.

An effective Energy Management System (EMS) such as one compliant with ISO 50001[15] will aid in the deployment of measures aimed at improving energy performance. Based on an extensive literature review, Prasetya et al[16] found significant improvements in energy performance and reduction in emissions through the implementation of an EMS. There was also a positive correlation between improvement energy performance and total energy cost savings. In a comparison of the potentials of companies with an EMS and companies without an EMS, Knayer and Kryvinska[17] found a positive effect of the EMS on energy efficiency in general and on individual measures such as lighting technology, energy monitoring and peak load management in particular.

The message here is that faced with a requirement to reduce energy use or emissions, facilities such as those covered by the SGM should consider implementing an energy management system and use the EMS as the foundation of a campaign to improve the energy efficiency of the facility.

Get your offsetting right

The Oxford Offsetting Principles[18] aim to help users avoid buying low quality offsets and ensure that their decarbonisation plans are compatible with achieving net zero. They are intended to be used by a variety of stakeholders including corporations and organisations when designing and delivering credible plans for achieving net zero.

The first of the Oxford Offsetting Principles recommends that organisations prioritise reducing their own emissions which minimises the need for offsets. If offsets are used, they should be verifiable, correctly accounted for and have a low risk of failing additionality requirements, reversal, and creating negative unintended consequences for people and the environment. The notion of “reducing emissions first” has been taken up by others such as the Grattan Institute[19] and the Climate Council[20]. Climate Analytics provided an in-depth analysis of why offsets are not a viable alternative to emissions reduction or avoidance measures[21].

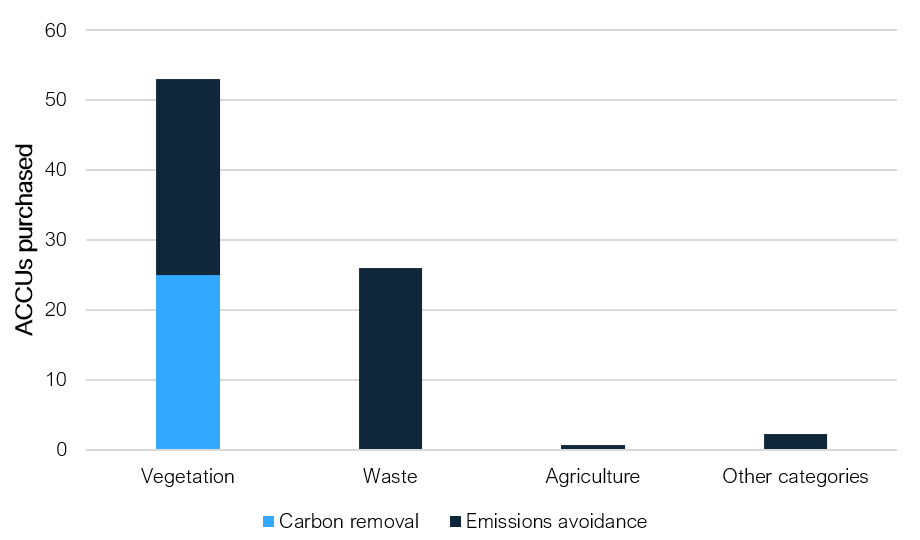

The second of the Oxford Offsetting Principles recommends a shift to carbon removal offsetting rather than offsets derived from measures that avoid emissions. While this has not been the case in the past as the majority of ACCUs have been derived from emissions avoidance (see Figure 2), future ACCUs are more likely to be sourced from carbon removal measures.

Figure 2: Most ACCUs purchased by the government represents emissions avoided[22]

The Independent Review of Australian Carbon Credit Units (the Chubb Review)[23] recommended that no new project registrations be allowed under the current avoided deforestation method (Recommendation 9) and that landfill gas methods and crediting period extensions should incorporate upward sloping baselines (Recommendation 10). Both will have the effect of reducing the volume of offsets created through to emissions avoidance. Further, there has been a significant reduction in the number of new landfill gas projects registered with the CER which suggests the scope for new ACCU creation using this method is limited[24]. So it appears that near-term ACCU creation will be dominated by reforestation/afforestation which are carbon removal measures.

The potential issue for businesses and especially businesses with SGM obligations is the perceived quality of offsets used to meet an emissions reduction objective. Several commentators[12], [25] have questioned the legitimacy of abatement delivered by measures used to create ACCUs. The prime example is the human induced regeneration method, and while there is no suggestion that the Australian Government will invalidate ACCUs created by methods subsequently shown to deliver insufficient abatement, the market may take a different view. The market may require businesses to acquire and surrender additional legitimate offsets to claim the achievement of targets.

Further, businesses can invest in activities that generate ACCUs and use these ACCUs to offset their facilities’ emissions. It is important that businesses engaging in offset creation meet the requirements of the Oxford Offsetting Principles.

Corporate renewable Power Purchase Agreements (PPAs) make sense tomorrow and even more sense today

In their most recent report into the state of the market for corporate Power Purchase Agreements (PPAs) in Australia[26], the Business Renewables Centre - Australia (BRCA) reported that in recent years the primary drivers for buyers of corporate PPAs have been to enable companies to meet their emissions targets, CSR goals and reputation. This was a change from earlier years when the driver was relief from electricity price shocks.

However, BRCA’s report noted that from 2023, electricity prices were set to again become a driver. The figure below shows how much wholesale electricity prices have rose from 2021 to 2022. The prices have come back from these peaks in the period from 2022 to 2023. However, the increase in volatility will drive adoption of PPAs as they offer a degree of price surety.

Figure 3: Wholesale electricity prices in the National Electricity Market[27]

Typical contracted prices for PPAs were closer or below the typical average wholesale electricity prices prior to 2022. We saw signs of upward pressure on PPA prices, with several commentators reporting rises of up to 35%[28], [29], [30]. The IEA sees rising interest rates, equipment price increases and constraints on the transmission networks driving up costs for developers[31]. Supply chain delays are also constraining supply of equipment while demand is rising.

Notwithstanding the recent upward pressure on PPA prices, a PPA offers electricity users lower prices than those currently seen in the electricity market. Further, PPAs offer a degree of price surety that will be valuable as businesses navigate the challenging years ahead.

The message for businesses is that if you are considering a PPA (and most medium to large businesses should be) then the time to kick off the process is now. Delays will only see businesses paying high prices.

What can we expect in 2024? Six sectoral decarbonisation plans developed and delivered – but not in time to help our 2030 target

While not related to the 2030 national target, business should be aware that the Climate Change Authority is driving decarbonisation plans for 6 sectors: electricity and energy, industry (including waste), the built environment, agriculture and land, transport and resources[32].

The plans are intended to provide a roadmap towards achieving net zero and will help to inform Australia’s 2035 emissions targets. The review of the decarbonisation pathways will be delivered by 1 August 2024. The Climate Change Authority is putting together advice on Australia’s 2035 emissions reduction targets. The advice will be submitted to government on or after 1 October 2024[33].

While the International Energy Agency (IEA) has released emissions reduction pathways and scenarios for sectors, Australian companies have had little to work with in the way of decarbonisation plans that relate to local conditions. The indications are that the plans will incorporate policy actions and technology investments to enable sectors to contribute to the government’s overall climate targets. Sectoral decarbonisation plans may encourage investment. In 2023, Chris Bowen, the Minister for Climate Change and Energy stated “government-guided sectoral plans are vital for attracting billions in new investment in decarbonisation in Australia”[34].

However in the context of Australia’s 2030 climate targets, with such a short period of time available, the remaining challenges to the realisation of our renewable energy target, and the speed with which we can hope to overcome the technology and skills drain to markets like the US, any sectoral decarbonisation plans will at best support a 2035 target.

Overall, with this challenging policy background it falls to the private sector to drive action if Australia is going to come close to delivering on our global commitment.

[1] AFR| Investment in renewable energy slumps 80pc as 2030 target fades

[2] AFR| Meeting 2030 energy targets close to ‘impossible’

[3] AFR| Compete with IRA or we’ll follow money super CIOs warn Labor

[4] Clean Energy Council| The Inflation Reduction Act

[5] AFR| Bowen dramatically expands green energy support

[6] Weiss| Net zero ambitions – now comes the hard part

[7] AFR| Meeting 2030 energy targets close to ‘impossible’

[8] Powering Australia | energy.gov.au

[9] Weiss| Net zero ambitions – now comes the hard part

[10] As noted earlier, the recently implemented Capacity Investment Scheme (CIS) seek to incentivise new investment in renewable energy generation backed by storage technologies such as batteries or pumped hydro. The objective of the CIS is to support the ongoing decarbonisation of the grid. The challenge that it will face is that it may not provide solutions to the challenges of shortages of skilled workers, planning constraints and global supply chain restrictions.

[11] IEA | Energy Efficiency 2022

[12] Ibid

[13] IEA | 7th Annual Global Conference on Energy Efficiency

[14] IEA | Industry – Analysis

[15] ISO| ISO 50001 — Energy management

[16] B Prasetya et al | The role Energy Management System based on ISO 50001 for Energy-Coast Saving and Reductions of CO2 emissions: A review of implementation, benefits and challenges

[17] Knayer, T., Kryvinska, N. The influence of energy management systems on the progress of efficient energy use in cross-cutting technologies in companies

[18] The Oxford Principles for Net Zero Aligned Carbon Offsetting 2020

[19] Towards net zero: Practical policies to offset carbon emissions (grattan.edu.au)

[20] What is carbon offsetting and is it worthwhile? | Climate Council

[21] Climate Analytics | Why offsets are not a viable alternative to cutting emissions

[22] Weiss| Net zero ambitions – now comes the hard part

[23] Chubb, Bennett, Gorring, Hatfield-Dodds | Independent review of Australian Carbon Credit Units

Executive Summary, Final Report, Recommendations and Key Findings

[24] Energetics’ analysis of Emissions Reduction Fund Register

[25] short_-_hir_additionality_july_2022_final.pdf (anu.edu.au)

[26] Business Renewables Centre Australia | Corporate Renewable Power Purchase Agreements: State of the Market 2022

[27] Wholesale Markets Quarterly - Q4 2023, Australian Energy Regulator

[28] Reccessary | European wind PPA prices rise 35% over last six months while solar prices drop

[29] LevelTen | Renewable energy PPA prices continue to rise despite Inflation Reduction Act relief

[30] BloombergNEF | Wind and Solar Corporate PPA Prices Rise Up To 16.7% Across Europe

[31] IEA | Are market forces overtaking policy measures as the driving force behind wind and solar PV? – Renewable Energy Market Update

[32] Net zero | Department of Climate Change, Energy, the Environment and Water

[33] WIQ | ESG Impact: 5 themes and developments to watch in 2024

[34] Ibid.