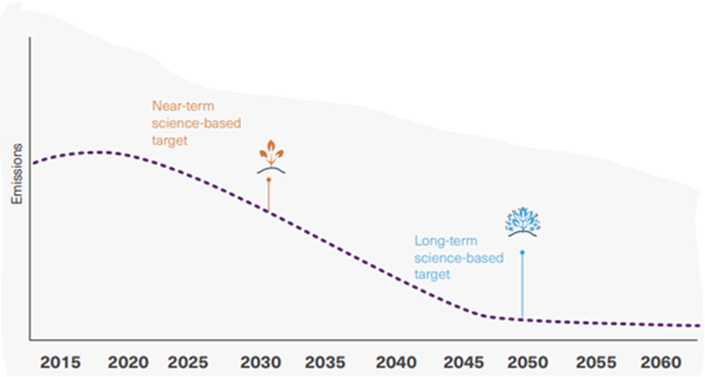

Figure 1: How short-term and long-term targets under the SBTi align (SBTi Net Zero Standard)

Messages for business

Key takeaways from the discussion are as relevant as ever; start by understanding your emissions footprint, consider both your short- and longer-term emissions reduction strategy, recognise that reaching net zero is a process and be transparent in your disclosure.

On the topic of offsets, you can read more in Energetics’ article, Carbon offsets: approach with caution.

A new standard for corporate sustainability disclosure

In a separate announcement and based on the Taskforce for Climate-related Financial Disclosure (TCFD) framework, the International Financial Reporting Standards (IFRS) Foundation’s newly established International Sustainability Standards Board (ISSB) will develop a global standard for sustainability reporting. Along with TCFD disclosure, which has seen increasing voluntary uptake and has been mandated by countries such as New Zealand, standardised sustainability disclosure will support transparency, investor decision making and the allocation of capital in financial markets. The IFRS has released two prototype documents which contains industry-level and more general sustainability recommendations[3]. Following appointment of a Chair and Vice-Chair, the Board will kick-off public consultations to inform its work plan. Australia was one of 37 countries whose Finance Ministers or Central Bank Governors joined in welcoming the announcement.

References

[1] Science Based Target Initiative | Resources for setting net zero targets

[2] Companies in the power sector must set targets to reach net zero no later than 2040

[3] IFRS Foundation |IFRS Foundation announces International Sustainability Standards Board, consolidation with CDSB and VRF, and publication of prototype disclosure requirements