Long term climate change, while foreseeable, adds uncertainty to investment forecasts and increases risk. Portfolio asset managers and investors, especially those investing in assets such as commercial real estate, are particularly exposed to physical risk through increased storm damage, flood risk and increased temperatures. Ambitious climate strategies directed by net zero emissions (NZE) shows commitment to action and will increasingly become a key differentiator in investment selection. Targeting NZE for owned and managed assets provides a pathway to both mitigating risks and attracting investors.

By combining climate science with business insights, a board can receive robust facts, data and metrics to clearly articulate the management of climate related financial risks, and the ability to project climate driven changes in the value of different assets and their productive capacity.

The opportunity in Australia

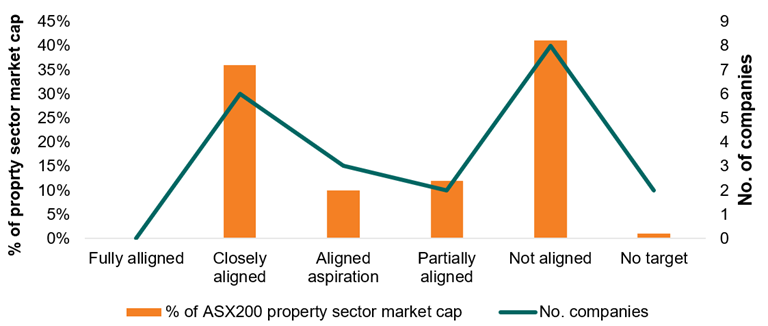

As of last year,[1] 19 companies within the Australian real estate sector had announced emissions targets. A number of large property developers such as Mirvac[2], Dexus[3] and AMP Capital Real Estate[4] announced net zero targets covering scope 1 and scope 2 emissions sources[5].

Companies are missing a significant opportunity for differentiation and leadership in this sector. Energetics predicts that in 2020, the number of NZE commitments will increase significantly.

Figure 1. Current emissions targets in the property sector[6]

Emissions reductions modelling can scope the task from now through to the achievement of a net zero target by 2050. From this work, business cases can be developed for:

- investments in energy efficient technologies to reduce energy consumption/demand

- a procurement strategy incorporating on-site generation and renewable electricity procurement such as a corporate renewable PPA to further reduce costs and exposure to energy market volatility.

- implementation and use of smart energy management systems that can optimise energy consumption and provide valuable business insights.

- tracking performance and reporting on progress

- managing climate risk dynamically by monitoring the scientific advice and community concerns.

How do I achieve NZE?

Investment portfolios require different strategies and opportunities for eliminating emissions. Many of these opportunities not only reduce emissions and increase investor interest, they generate savings for the assets.

A pathway for setting and achieving NZE is outlined below.

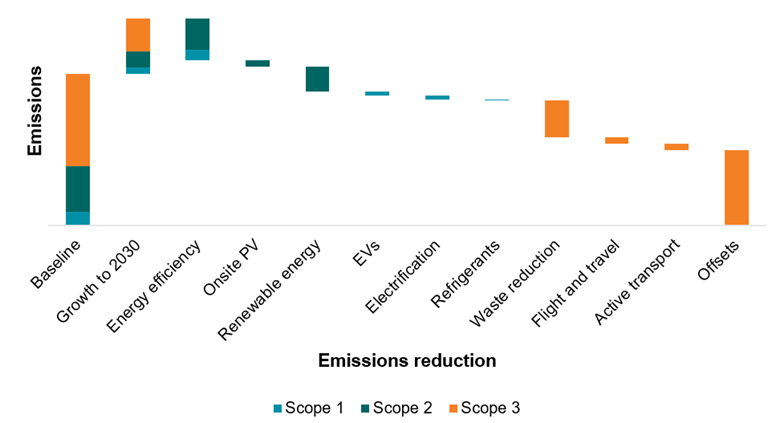

Figure 2. NZE roadmaps

Scope and define

Scoping, defining and calculating the portfolio’s carbon footprint is the first step in reducing emissions. Understanding a portfolio’s emissions is more complex than just adding up your electricity and gas use or using your NGER report. With a range of assets types within each investment portfolio including commercial offices, warehouses, industrial and retail, a range of emissions sources may be prevalent.

Identify opportunities and develop business cases

Identifying emissions reduction opportunities to reduce each emissions source may include:

- Electric vehicles, electrification, refrigerant replacement (scope 1)

- Energy efficiency, NABERS uplift strategies, on-site renewable energy, renewable electricity procurement (scope 2)

- Waste reduction initiatives, flight and travel reduction, active transport (scope 3).

Including the financial impacts as part of these initial investigations will assist fund managers in understanding the investment requirements of achieving the target. While cost should not be the sole driver, it is often an important consideration. Some opportunities provide financial savings (energy efficiency, solar PV), some are cost neutral (renewable electricity procurement, EVs) while other may increase costs (refrigerant replacement, electrification).

It should be noted that offsets are typically required to meet a NZE target. The cost of offsets can significantly impact overall costs and should be a focus throughout the target setting process. Developing offset strategies and pricing forecasts are key requirements at the business case stage.

Actionable roadmaps

Energetics has experience developing emissions baselines and identifying emissions reduction opportunities. Together these are typically used to set interim corporate targets. Our experts have found that communication of objectives both within organisations and externally is key to reaching a target. Tools such as waterfall charts (below) aid in helping investors understand emissions sources and opportunities. Having a clear path to implementation provides stakeholders and investors with confidence in the strategy.

Figure 3. Example emissions roadmap

Implementation and offsets

Each emissions reduction opportunity should be implemented in line with the roadmap. Continuous monitoring of performance and achievements, and subsequent stakeholder communication and engagement, increases the program’s chance of success.

Once emissions are reduced through direct actions, carbon offsets are required to offset residual emissions. Carbon offsets are seen as the last resort as they are a cost to the organisation offering no financial returns and can be seen negatively by investors if not supported by real action first. Due diligence should be undertaken to ensure that offsets to be purchased come from valid emissions reduction projects and that the project type or location of the project does not expose the company to reputational risk. Companies also need to be able to demonstrate that they are the unique purchaser of the offsets and that the offsets are not being recycled or reused in any way. Typically, this is through a transparent retirement of the offsets in a registry.

Each of these options provide benefits, but no single action will meet the target. A co-ordinated, planned approach that is clearly and widely communicated will promote a company culture that not only supports reducing emissions, but identifies further, and possibly innovative, opportunities.

Creating operational value in four ways

Firstly, as NZE requires a broad approach to energy and emissions management, it aids portfolio managers in identifying and implementing energy and emissions saving opportunities which in turn reduces operational costs. Secondly, sustainable buildings can improve rental yields by attracting rental premiums from tenants looking for both environmentally and operationally improved buildings. Thirdly, by improving the sustainability performance of assets and portfolios, an increased capital valuation can be achieved at sale. Finally, improved ESG management can enhance owner – tenant relations and increase asset visibility, therefore improving interest in investment. 5-star NABERS buildings have been found to attract a 9% rental premium and lower vacancy rates compared to buildings with less than 2 stars[7] and a US study found that for sustainable buildings operating costs decreased by 8% to 9%, building values increased by 7.5%, Return on Investment (ROI) improved by 6.6%, occupancy ratio increased by 3.5%, and rent ratio increased by 3%[8].

Lead, don’t lag

Investment portfolio managers should define, scope and identify opportunities to reduce emissions to net zero by 2030. Aside from the increasing pressure to reduce emissions, there are other drivers: rising energy costs, investor uncertainty, physical climate impacts, reputational impacts (as an industry laggard), and potential market differentiation opportunities. While 2030 is a decade away, this challenge should not be underestimated. Setting clear roadmaps early will enable asset managers to identify opportunities and implement them at the correct time for the business. Reducing energy consumption and limiting emissions can provide savings to organisations and offer communication and marketing opportunities in competitive environments.

Energetics can support you in the development of your net zero emissions target and pathway to its achievement. Please contact us for more information.

References

[1] Climate Works Australia | Net Zero Momentum Tracker Property Sector

[2] Mirvac’s plan to reach net positive carbon by 2030

[3] Dexus | Sustainability Approach

[4] AMP Capital Media Release | AMP Capital launches ambitious 2030 real estate sustainability strategy

[5] These targets are defined as “closely aligned” as they do not include scope 3 emissions and therefore are not as “fully aligned” to the Paris Target of net zero by 2050 as defined originally.

[6] Climate Works Australia | Net Zero Momentum Tracker Property Sector (September 2019)

[7] Australian Property Institute | Building Better Returns