Over the last nine months, prices for calendar year 2023 electricity base futures have increased by about 180%. End users whose retail electricity supply agreements are due to end are facing an extraordinary increase in their electricity costs if they choose to sign a new standard electricity supply contract – prices on offer have skyrocketed as retailers face increased hedging costs.

Energetics advises commercial and industrial end users to consider several options, including portfolio diversification through contract laddering and a combination of short term and long-term contracts, such as renewable Power Purchase Agreements or behind-the-meter physical hedging opportunities. Among these, progressive purchasing remains an effective risk management option for large and medium energy users, when developed and utilised well.

As during the ‘millennium drought’, which saw futures prices more than double in less than six months during 2007/08, flexible or progressive purchasing arrangements are today being discussed at the C-suite level as a time-to-market risk mitigation strategy. And, as it was the case back in 2007/08, we advise that this strategy, which consists of purchasing load in parcels (e.g. in 1MW quarterly clips) rather than in one annual tranche, is not guaranteed to reduce costs. Energetics has seen many examples where users with progressive purchasing strategies have failed to utilise it as an effective risk management instrument. In the worst situations, organisations waited too long before making purchases (sometimes in erroneous anticipation of a price decrease), and subsequently faced the prospect of being forced to buy 100% of their annual volume in three months prior to delivery - at a cost of millions above their budget, in a market that moved against them. When such end users approach Energetics in the final months before delivery, having missed the opportunity to purchase at optimal times, we cannot offer an easy fix.

In this article we outline the key elements that must be included in an effective progressive purchasing approach, and highlight the need to relate business risk tolerance and risk management processes - a relationship which is increasingly important as energy market volatility is expected to last until the energy ‘supercycle’ that we are in is brought into balance.

Key components of a risk management framework

Before entering into a flexible/progressive purchasing arrangement, it is important to understand and clearly specify the amount of risk your business is willing to take in anticipation of possible benefit, and at what points (in price, time, or across a range of other metrics) action will be pursued to hedge the risk exposure of the portfolio. It is essential to put two things in place:

-

A multi-tier risk management framework with triggers and ‘stops’ to help preserve budgeted capital and avoid large losses against budget

-

Ongoing market monitoring and opportunistic transaction processes.

Disciplined application of this framework and ongoing market monitoring under volatile market conditions help provide advance warning of any potential for cost increases (or decreases) so that the downside (or upside) risk position can be re-evaluated if required. This is particularly important to identify significant or structural market shifts, and even decide if a ‘stop-loss’ protocol should be implemented.

Establishing triggers for action

There are a number of triggers that we generally recommend:

-

Price and time to maturity: based on the underlying principle that the lower the price and the shorter the time to maturity of the instrument, the more volume should be purchased. When setting these triggers, it is important to note that with the unprecedented impact of the clean energy transition that the electricity markets are going through, historical trends are not necessarily reflective of current and projected market conditions. Budget cap and trigger prices must be set based on a forward-looking market view. For this, Energetics uses its in-house spot price series from our Plexos® market simulation model to derive futures contract projections applying a market price for risk. Furthermore, these triggers need to be dynamic, as market shifts and volatility may mean that prices move beyond the outcomes expected when initial price triggers were set up. For example, rigidly applying trigger prices set up in 2020 to purchase the load for calendar year 2023 may have resulted in a painful electricity budget increase, as the market moved well above what could have been anticipated in 2020. In such situations, price trigger inflexibility would have likely led to panic buying close to delivery start date.

-

Risk metrics: introducing a risk measure such as Value at Risk (VaR), or Expected Shortfall allows a buyer to take into consideration not only changes in price, but also market volatility, and thus manage a whole portfolio of instruments based on the riskiness of the position, not simply open volume.

-

Dates: such limits should not change, and are designed to prevent the buyer from holding the whole portfolio open against an unfavourable market trend, hoping for a better future, which may never eventuate.

Overall, the selection of triggers and price limits is a trade-off between possible future opportunities and gradual hedging. Discipline in the execution of such a pre-agreed framework is critical to avoid protracted gambling on future market trends.

Stop-loss orders

Another feature of an effective progressive purchasing risk management framework is a set of stop-loss orders. These are put in place as a measure of last resort, intended to cut losses and save budget throughout periods of unprecedented market shifts. However, a significant level of risk remains in execution of any stop-loss process, due to the high level of volatility and often low liquidity in the electricity futures markets. Energetics’ recommended process addresses some of these risks by using a gated decision tree considering both offered and actually transacted volume and price.

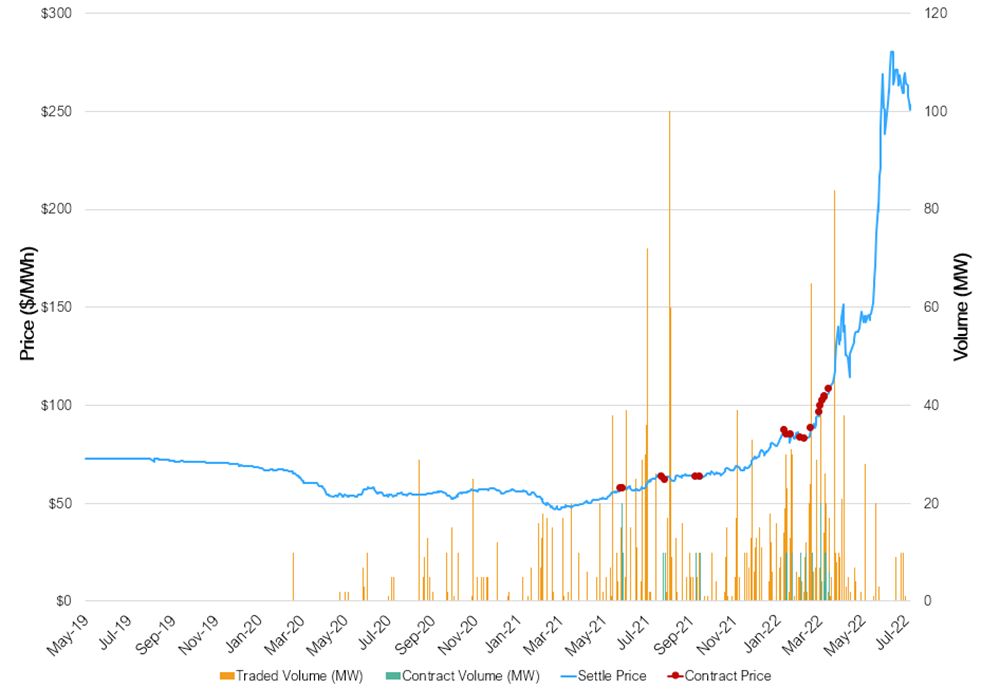

By way of example, Energetics successfully managed stop-loss activation for our clients in relation to FY18 purchases during summer 2016/17 when the Hazelwood power station’s early closure was announced, sending prices into a sharp rally. We also did so more recently, when managing FY23 purchases for several clients. This is illustrated in the graph below, showing a set of successive purchases of NSW FY23 parcels to close a position before reaching a set budget cap – further delays would have resulted in significant energy cost increases for the organisation, while activating the stop-loss process helped them stay on budget in a rallying market.

Figure 1: Example of price limit application to NSW FY23 volume

The ability to respond quickly

In a well-designed flexible/progressive purchasing framework, a delegation of authority matrix establishes who in the organisation (and to what extent) holds decision-making power to make purchases, and who has the authority over position limits. The presence of clear triggers and limits which are pre-approved by the relevant organisational stakeholders, and the purchasing authority delegation, enable action to be taken rapidly when the market moves. Such responsiveness is not only essential in a dynamic market where offers have short term validity, it also ensures that no unnecessary risk is taken by the organisation.

Managing market risks, not just averaging-in

Finally, ongoing monitoring and proactive flexible purchasing contract management involves the application of market-linked risk metrics to measure the potential cost of a severe adverse market movement. Energetics utilises Value at Risk (VaR), which is a widely-used financial risk metric that allows for a clear visibility of risk at a portfolio level:

-

Based on historical market performance, VaR gives an indication of the possible size of an adverse market move over a number of trading days realistically required to close the position. This provides a view of how much budget is at risk, taking into account current and historical prices, and the level of recent market volatility.

-

As a portfolio-level risk measure, VaR takes into account price movement correlations between different instruments (for example different contract tenors or different states, if your portfolio spans across jurisdictions) therefore acknowledging the compounding effect of price movements.

Energetics’ team has extensive experience utilising risk management practices in energy markets. We leverage this experience to demonstrate to stakeholders the alignment between corporate risk objectives, risk limits and portfolio performance and to apply a balanced perspective when informing purchasing decisions. Please contact the authors or your Energetics’ account manager if you have any questions.