The hype around electric vehicles has been around for some years ‘driven’ in large part by Elon Musk and Tesla. Momentum has grown since the Tesla Roadster sports car was launched back in 2008, followed by the model S and the model X[1]. The Chevrolet Bolt was the first mass market electric vehicle released in 2016 and Tesla have since announced their Model 3 for broader markets. With the development of battery technology and falling costs, has the time for electric vehicles (EVs) arrived? What are the possible environmental and cost implications?

Over 2017, Energetics has seen interest from an increasing number of businesses and governments to understand not only the rate of growth in the EV market, but the implications for Australia’s emissions reduction targets. In this article, we share our insights and analysis.

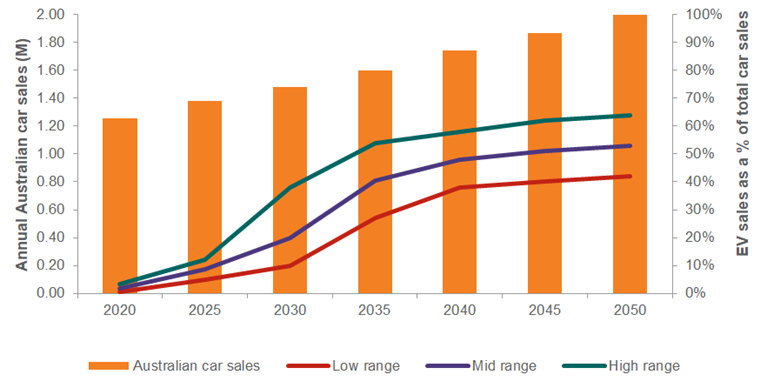

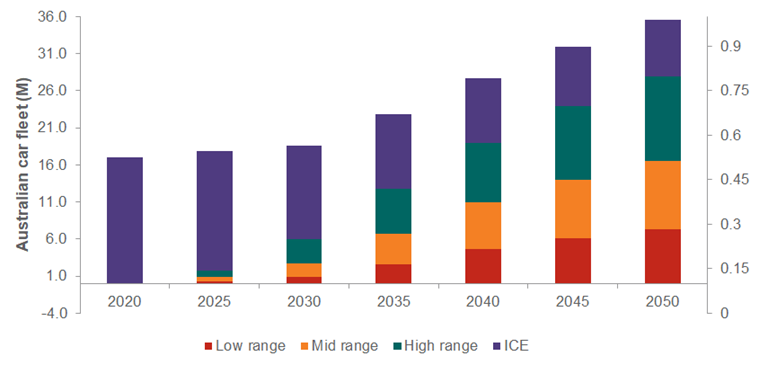

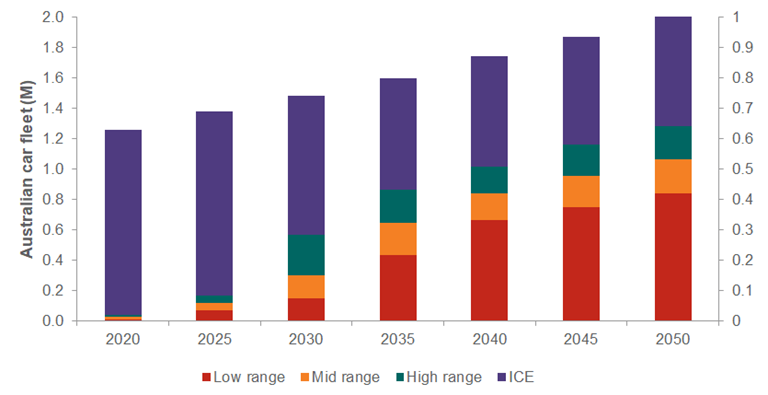

40-60% of the Australian car fleet is forecast to be electric by 2050

There are currently many competing EV technologies. The main three are the petrol hybrid, plug-in hybrid electric vehicle (PHEV) and battery electric vehicles (BEV). A battery electric vehicle (BEV) uses rechargeable battery packs and have electric motors connected directly to the wheels instead of an internal combustion engine to power the vehicle. Whereas a PHEV has an internal combustion engine (ICE) to either recharge the battery or to provide extended range capabilities. PHEVs have the ability to be recharged from grid electricity to reduce the consumption of hydrocarbon fuels.

Based on the Bloomberg report Electric Vehicle Outlook 2017[2] we expect PHEVs to represent a major proportion of EV sales from now to 2025. However after this, BEVs should be the majority of EV sales. This is due to a number of factors and they’re not just financial. Other compelling drivers include the lower engineering complexity, lower cost of ownership and higher emissions savings, and as the price of battery technology reduces, the cost of ownership of BEVs falls.

Furthermore, the International Council for Clean Transportation[3] compared the first-owner four year cost of operation for a medium passenger car. This analysis finds that the costs of owning and operating an EV becomes competitive with an equivalent ICE vehicle by the mid-2020s, after which point EVs are likely to be cheaper. Figure 1 shows the average cost of ownership for EV technology (of 100, 150 and 200 mile electric range) compared to an ICE vehicle.

Importantly, the upfront cost of an EV is also forecast to be less than that of an ICE vehicle by the mid-late 2020s. The forecast of a crossover in competitiveness by 2025 is shared by other analysts including Bloomberg New Energy Finance[4] and UBS[5]. Together, these forecasts suggest that the total cost of ownership and then the purchase price of EVs will fall below the corresponding figures for ICE vehicles within the next few years. Once this occurs the financial barrier to the uptake of EVs will fall away.

Globally, electrified alternatives to ICE vehicles are expected to approach cost competitiveness within the next decade[6][7], suggesting that the switch does not have to impose significant consumer or economic costs. EVs are already cheaper to operate and maintain. When the purchase cost reaches parity we will see a large disruptive force in the transport market.

A range of predictions for the uptake of EVs in Australia are available, however 40-60% of new vehicle sales by 2050 seems a conservative estimate. With around 137 million cars being sold globally in 2050 and approximately two million in Australia, this equates to around 800K-1.3M new EVs on Australian roads each year.

Figure 1: Cost of ownership of EVs[8]

Figure 2: EV% of total car sales[9]

Figure 3: EVs in Australian car fleet[10]

Figure 4: EV car sale predictions[11][12]

Watch for developments in China and India

India and China are growing their EV fleets, with the latter seeing EVs as an opportunity to leapfrog the traditional ICE manufacturers. As both nations have struggled with significant urban air quality issues, EVs offer a pathway to addressing this challenge. With EVs producing zero emissions at point of use, the air quality will be drastically improved in heavily populated cities such as Beijing and New Delhi. As these countries invest heavily in EV technology, the cost of EVs will drop further[13]. India is seeking to make all new cars electric by 2030[14]. With transition on this scale, increased demand and the entry into the market of non-traditional manufacturers, EV take-up globally, and in Australia, could occur more quickly than forecast.

What could EVs do for the task of reducing national emissions?

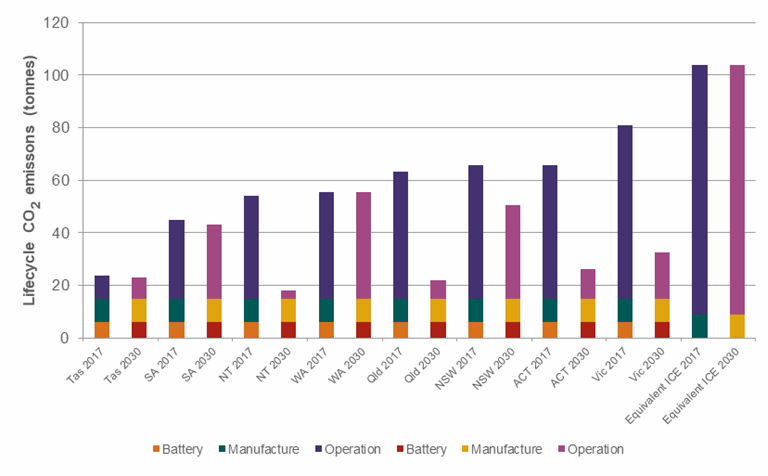

Life cycle assessments have shown that ICE vehicles produce most of their carbon emissions during their operational life. The EVs on the other hand have much higher start-up emissions due to the resources and energy required to produce the batteries.

Figure 5: Life cycle carbon of EVs per state[15]

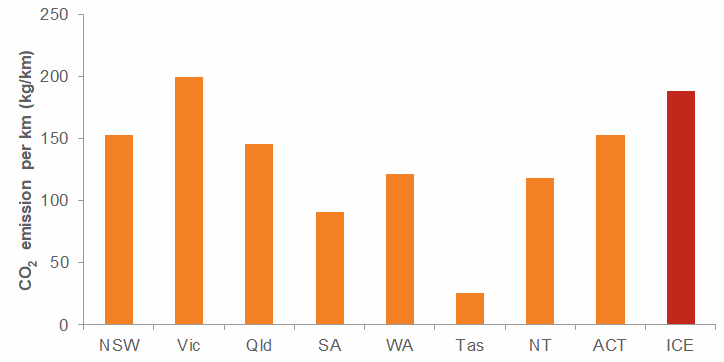

The operational emissions from EVs are directly linked to the emissions intensity of the electricity used to recharge the battery.

Figure 6: CO2 emissions per km per state[16] [17] [18] [19]

Australia’s electricity system is slowly decarbonising[20] as renewable energy implementation increases. With recent renewable energy and battery projects announced, and the retirement of coal fired power stations, the emissions from EVs will drop significantly. Ultimately, the environmental case for high EV use will become undeniable. Increasing the use of renewables will further boost this case.

What roles could governments play?

Government readiness

The business case for EVs is compelling and potentially there is no need for additional resources or incentives from governments to accelerate EV take-up. However, the impacts on communities, work and the broader economy are potentially disruptive. Therefore planning and readiness for this transformation is essential.

Currently the roads and infrastructure budget is mainly funded through fuel tax, with other taxes including registration and licence fees. However, as EVs become more wide spread, the reduction in revenue from fuel excise could cause a large budget ‘black hole’. The shortfall is estimated to be billions of dollars and present a significant challenge for policy makers and infrastructure planners.[21]

Governments also need to ensure that there are no barriers within their planning and legislation rules to restrict the implementation of charging stations and home based EV charging solutions. The infrastructure needs and implications of EVs are significantly different from those of ICE vehicles, suggesting that government approvals should be designed to smooth what could otherwise be a challenging transition. Certainly in the NRMA’s 2017 report, The future is electric, we see six recommendations to Australian governments that include the establishment of an intergovernmental panel to manage the transition and support for the rollout of charging infrastructure, especially in rural and regional areas[22].

The reduction in ICE vehicles will have a significant impact on the traditional automotive industry. The employment of mechanics will reduce as more technical electronics knowledge is required. The skill base requirements will be disruptive to this industry. The NRMA is moving towards EVs[23] but small mechanic businesses throughout the country are unlikely to be prepared for a significant shift.

This change in the skills required and the impact on state and federal budgets means that different strategies will be needed to maintain and manage our future infrastructure and work force needs.

Increase in public charging stations

As with any disruptive technology a number of barriers have been identified that will impact the take up of EVs. The main concern is around the range and the charging time. With current, high end EVs having a range of over 500km[24], the issue becomes the time to charge. A network of charging stations that enables longer journeys is widely regarded as a pre-requisite for mass EV uptake. This is true even in markets where most vehicles’ daily travel is far less than the maximum charge distance[25]. Hall and Lutsey[26] found that in high-EV-uptake markets the public provision of charging stations is much higher than in markets with relatively low EV uptake.

A second question is the type of charging station provided. ‘Level 1’ charging points provide less than 2kW of power, and so an EV needs to be connected for eight or more hours to fully charge. These are typical at-home chargers accessed by a standard power point. ‘Level 2’ charging stations provide power of 3.8-22 kW, charging at a rate of 18-40km/hour. These are significantly cheaper than DC fast charging stations, which operate at 50 kW or above and can recharge an EV in under an hour. The costs of charging infrastructure differ significantly across different markets.

However, we can also see a strong business case for enterprises such as shopping centres, parking stations and restaurants to offer charging facilities which in turn can encourage patronage. In capitalising on this business opportunity the required infrastructure for an EV fleet could grow considerably.

The experience in other markets across the world

“Electric vehicle owners in California more frequently have access to home and workplace charging, and one public charger per 25 to 30 electric vehicles is typical. In the Netherlands, private parking and charging are relatively rare, and one public charger per 2 to 7 electric vehicles is typical.” A similar range is found across multiple studies[27] [28].

Figure 7: charge points per capita[29]

End of life recycling

With battery production costing a high proportion of the total energy consumption, a robust recycling model must be established. With high value materials a recycling scheme will not only reduce emissions but total cost of EV production. Currently around 80% of ICE vehicles can be recycled[30]. This level, if not higher, needs to be achieved for EVs. There is not a large enough EV retirement rate to merit a recycling system; however as the number of EVs increases, this scrappage will increase[31].

EVs are coming!

Transformational technology always takes time to gain traction in the market but the business case and environmental benefits point to a high uptake of EVs. Arguably consumers are likely to move towards EV ownership with or without Government intervention however opportunities exist for Government and business to lead by example by not only transitioning their own fleets to EVs, but by implementing the charge point model to offer greater value to customers and increased revenue.

References

[2] Bloomberg New Energy Finance | Electric Vehicle Outlook 2017

[3] The ICCT | Evolution of Incentives to Sustain the Transition to a Global Electric Vehicle Fleet

[4] Bloomberg New Energy Finance | Electric Vehicle Outlook 2017

[5] Advantage Lithium | UBS Article

[6] Bloomberg New Energy Finance | Electric Vehicle Outlook 2017

[7] The ICCT | Evolving Incentives white paper

[8] The ICCT | Evolving Incentives white paper

[9] Bloomberg New Energy Finance | Electric Vehicle Outlook 2017

[10] Bloomberg New Energy Finance | Electric Vehicle Outlook 2017

[11] Bloomberg New Energy Finance | Electric Vehicle Outlook 2017

[13] Nikkei Asia | China goes all out to be king of the electric car

[14] Reuters | India's auto industry gears up for government's electric vehicles push

[15] Union of Concerned Scientists | Cleaner Cars from Cradle to Grave

[16] Australian Government | National Greenhouse Accounts Factors August 2015

[17] Push EVs | Electric cars: range and efficiency comparison

[18] Green Vehicle Guide | Vehicle Emissions

[19] ABS | Survey of Motor Vehicle Use, Australia

[20] IPCC AR4 | Emission Factors for Greenhouse Gas Inventories

[21] ABC News | Electric cars are breaking our roads, here's how

[22] NRMA | The Future is Electric

[23] NRMA | The Future is Electric

[24] Fortune | Tesla Quietly Introduces Longest-Range Electric Car on the Market

[25] Zhou et al | Plug-in Electric Vehicle Policy Effectiveness: Literature Review

[26] The ICCT | Emerging best practices for electric vehicle charging infrastructure

[27] IEA | Global EV Outlook 2017

[28] Climate Works | The state of electric vehicles in Australia

[29] The ICCT | Emerging best practices for electric vehicle charging infrastructure

[30] The Balance Small Business | 20 Auto Recycling Facts and Figures

[31] The Guardian | The rise of electric cars could leave us with a big battery waste problem