Corporate renewable power purchase agreements (PPAs) have become a key consideration in 100% renewable energy, carbon neutrality and/or net zero emissions strategies. In addition to the emissions reduction benefits, a corporate renewable PPA offers a potential hedge against medium and long-term electricity market price risks.

A growing number of organisations are, however, looking at Large-scale Generation Certificates (LGCs)-only offtake agreements. These agreements deliver the same emissions reduction benefits as a PPA, but without the energy component. This article looks at the drivers behind the rise in LGC-only offtake agreements and, if your organisation is exploring this pathway, what you must consider to ensure the best outcomes.

What is driving interest in LGC-only offtake agreements?

Most large organisations that have followed developments in Australia’s burgeoning corporate renewable PPA market, would be most familiar with renewable energy deals such as a financial PPA or a supply-linked PPA. The electricity market price hedge that can be structured within such deals has been valued by many organisations at a time of unprecedented transformation in the electricity markets. This has especially been the case where electricity constitutes a material part of their operating costs and increases in energy costs cannot be readily passed through to customers. However, the design and execution of PPAs can be complex and requires sophisticated risk management capacity within buyer organisations.

Consequently, some organisations are considering LGC-only offtake agreements especially when:

- They can readily pass on the energy cost increases to customers

- The size of their electricity bill is relatively small compared with the PPA transaction cost

- Near term electricity markets are trending down and they wish to defer the start date of a corporate renewable PPA, but need a one to three-year bridge in their emissions reduction strategy and / or

- Long term electricity consumption is uncertain, resulting in a smaller commitment for the amount of electricity contracted under a long term PPA. A multi-year stepped LGC purchase program can be attractive and used to top up LGCs secured as part of a PPA.

Price drivers: LGC prices have dropped by more than 50% since early 2018

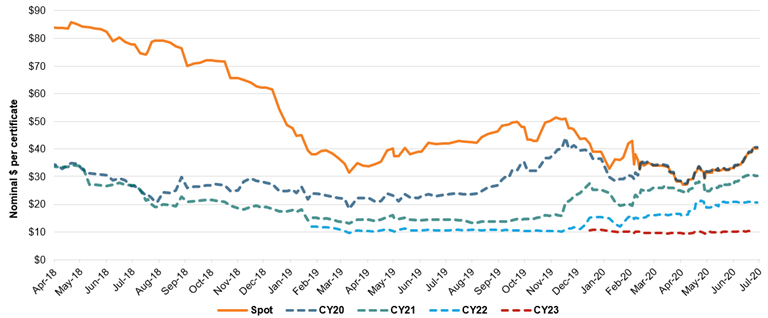

When LGC spot prices trended around the mid-$90 per certificate in 2018 as illustrated in Figure 1 (nearly doubling the cost of renewable energy compared to black power) few organisations deemed an LGC-only offtake an attractive option for reducing their emissions. Today, however, spot prices are down by more than 50% from their highs of two years ago.

Figure 1: LGC price evolution

It is expected that the value of LGCs will continue to trend downwards as reflected in Figure 1, with the price of LGCs for delivery in latter years trending lower. Although pricing on the forward market for LGCs is limited to three years ahead, price trends for delivery beyond CY23 are evident from direct tender processes conducted by Energetics.

So where are LGC prices likely to trend in the medium and long term?

Some commentators[1] still predict that the LGC price will bottom out at zero once the Commonwealth’s 2020 Renewable Energy Target (RET)[2] is met. This target is accepted as readily achievable by many, including the Clean Energy Regulator (CER).[3]

However, there are a number of factors that must be considered in the price outlook. Most immediately, the impact of COVID-19 which has contributed to a further slowdown in new renewable energy investment due to the near term fall in electricity prices and uncertainty about when demand for electricity will rebound. Compared to previous estimates, this may result in lower volumes of LGC supply beyond 2020 from projects where final investment decisions have been delayed. Furthermore, the markets for renewable energy certificates are more complex than for other regulatory instruments where one may be able to presume that the unit produced over and above the regulated target has a value of zero.

Other considerations include:

- Energetics holds the view that LGCs have a value as a high quality and easy to use instrument to reduce carbon emissions associated with electricity use.[4] Whilst an LGC is a commodity with a value attached to the RET until 2030, 1 MWh of renewable energy also has currency in the voluntary emissions reduction market.

- Specific to the rules of the scheme in Australia, the ‘tail’ of under compliance with the RET is expected to be significant and is likely to provide price support to LGC suppliers well beyond 2020. Under the rules of the RET scheme, liable entities may carry forward less than 10% of their liability for a particular year without incurring a shortfall charge.[5] However, many liable entities are also deferring their obligation with the intent of benefiting under the refund mechanism of the RET Scheme. This mechanism enables liable entities to claim back the $65 / certificate[6] charge applied to shortfalls within two years of having incurred the charge, subject to meeting a number of criteria specified by the CER.[7] As at 6 March 2020, liable entities advised the CER that they will collectively under-surrender their 2019 obligation by 25% (i.e. over 7.7 million certificates, which is more than a 50% increase in the 2018 LGC shortfall). Some such as Engie/Simply Energy and Flow Power are deferring 100% of their 2019 obligations. ERM Power and the Alinta Energy Group between them account for 50% of the 2019 LGC shortfalls with shortfalls of 2.55 million and 1.35 million certificates respectively. [8]

- In the long term, the LGC floor price is expected to be set by the relative emissions reduction value of an LGC, compared to the price of a tonne of carbon as reflected in the price of an Australian Carbon Credit Unit (ACCU) which is currently around $16 / tCO2-e[9]

- In the short and medium term, the market power of retailers and generators holding large portfolios of LGCs will influence pricing.

How to optimise an LGC-only contracting strategy

Organisations participating in NABERS (National Australian Built Environment Rating System) are often procuring GreenPower®[10] through their electricity retailer to benefit from an improved star rating when a building is running on renewable energy. This has the convenience of on-bill reporting.[11]

This convenience however may come at a premium – primarily due to the short-term nature of these contracts. This premium may not be justified if an organisation is committed to a long-term emissions reduction target and is able to make a medium to long term commitment to procure LGCs.

If the total volume you seek to procure exceeds 100,000 certificates for a single year or cumulatively across multiple years with a minimum annual volume of 30,000, in Energetics’ experience it would be beneficial to run a separate request for proposal for the provision of LGCs.

If you decide to do so, Energetics strongly recommends that you seek offers from both retailers and renewable energy project developers.

The inclusion of renewable energy project developers increases the complexity of the procurement processes. A direct linkage to a project may expose the buyer to reputational risks, whilst they may also prove to be weaker counterparties, when compared to large retailers. However, with effective due diligence, reputational and counterparty risk can be mitigated. The inclusion of developers offers benefits such as:

- Providing the buyer with the potential brand benefit of linking their supply of renewable energy to a specific project

- Increased competitive tension which will deliver greater cost savings.

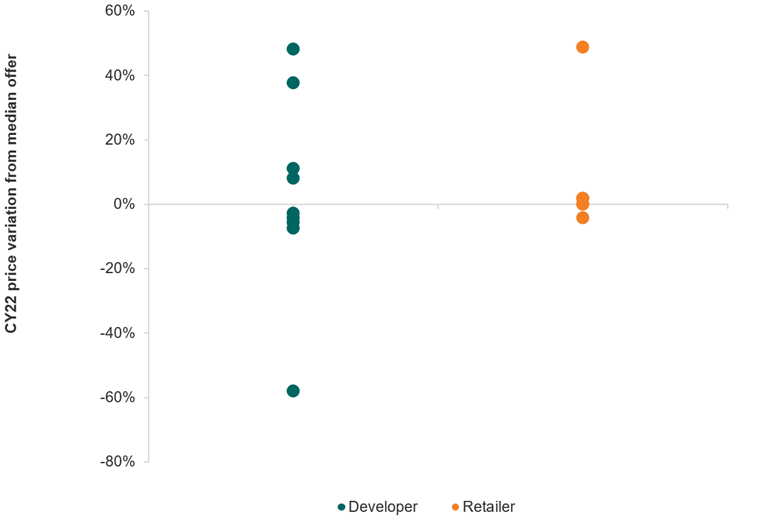

Based on observations from recent GreenPower® and LGC-only offers, bidders hold widely divergent views on the value of LGCs. Even in the near term (i.e. CY21 to CY23) the spread of offers, excluding outliers,[12] is typically greater than 30% and as high as 60% in later years. Illustrated in Figure 2 is the variance in offers received relative to the median price offer for a recent tender for the provision of CY22 certificates.

Figure 2: High variability in the offered certificate prices for a recent CAL22 LGC only tender

The widespread across the prices in our assessment could be attributed to some bidders basing their offers on one, or a combination, of the following needs:

- To recover the cost of their LGC book at a premium (retailers)

- To price at a premium or discount to the prevailing forward market prices in the initial years (retailers and generators)

- Setting prices somewhat disconnected from the near-term market based on the supplementary cashflow required from LGC sales over and above contracted or expected energy-only revenue streams (generators).

Underpinning these different strategies are widely divergent views amongst suppliers on the long-term value of an LGC.

Buyers can benefit with a well-designed procurement process, but Energetics strongly advises that, where practical, contract terms align with the AFMA Environmental Product dealing conventions, adjusted to reflect the longer-term nature of the envisaged transaction.

References

[1] Australian Financial Review | Renewables trapped in the oil wreck

[2] The Large-scale Renewable Energy Target (LRET) obligations for 2020 is 33,000,000 megawatt hours (MWh) and held constant until 2030 under current legislative provisions.

[3] Clean Energy Regulator | 2020 Large-scale Renewable Energy Target capacity achieved

[4] i.e. the difference between the average emissions intensity of the grid and zero emissions renewable energy source

[5] Clean Energy Regulator | Shortfall and shortfall charges

[6] This is non tax-deductible charge, with the tax effective charge about $93/certificate

[7] A refund on a paid shortfall charge may only be claimed if (1) the refund claim is made during the allowable refund period of 2 years (2) the liable entity did not have a large-scale generation shortfall in the year immediately before the year in which the refund is claimed, and (3) additional certificates are surrendered. See: Clean Energy Regulator | Refunds of large-scale generation shortfall charges

[8] Clean Energy Regulator | Certificate shortfall register

[10] GreenPower® is a “branded” LGC accredited by GreenPower which is the only voluntary government accredited program that enables electricity provider to purchase renewable energy on behalf of household's and business. It is a joint initiative of the ACT, NSW, SA and Victorian governments

[11] It is also possible to procure bulk GreenPower® through a broker or directly from a generator that are certified under GreenPower® Connect, but without the convenience of on-bill allocation

[12] In some cases, the winning bid or very high prices retail offers