Recent critiques of carbon credits are based on concerns about the veracity of the methods and calculation tools that the government provides for calculating the abatement for certain land sector methods. The criticism has echoed throughout the industry and drawn the attention of boards and executive teams seeking to understand the outlook for future purchases, or the creation, of offsets. In the June 2022 issue of Company Director, the publication of the Australian Institute of Company Directors, Energetics’ Head of Strategy, Sally Cook was interviewed on the role of offsets in a company's net zero strategy and how their quality can vary. In the article, "Offsets Adrift", Sally provides insights and a checklist for company directors. An excerpt is below.

To follow are further insights from Sally.

A short guide to offset integrity

A number of voluntary and compliance standards have emerged over time, issuing offsets of varying quality. As more companies make carbon neutral and net zero commitments they are increasingly asking how to assess and purchase quality offsets, and whether the price premium for ACCUs is justified. It has become, however, very difficult at face value to say ‘these offsets are good, these are not’. Veracity is a function of the standard (e.g. Australian Carbon Credit Unit (ACCU)), the method (e.g. human induced regeneration (HIR)) and even the individual project (e.g. as highlighted in the media recently, HIR projects in arid areas[1]). In general, the standard usually defines the high-level attributes (such as requirements for audit, registry for tracking the unit, and governance for establishing new methods) and the method usually defines how the emissions saving is calculated for an individual project.

For ACCUs all offset projects are subject to periodic audit. The Emissions Reduction Assurance Committee (ERAC) also undertakes reviews of method integrity. The recent media scrutiny helps to shine a light on the integrity of the method review process, the need for continuous improvements in these methods over time, and the important role of technical experts in the review process. Less frequently highlighted is the need for a position on sharing the downside (between Government and offset originators) if post-hoc the methods are found to overstate the abatement.

What to look for in selecting offsets

Some of the more commonly purchased offsets by Australian companies are ACCUs, Gold Standard Verified Emissions Reductions (VERs), and Verra Verified Carbon Units (VCUs). Certified Emissions Reductions (CERs) are also available and generally at lower cost, however additionality (whether emissions reductions would have been achieved in business-as-usual circumstances) and vintage (how much time has elapsed since the emissions reductions were achieved) are in contention.

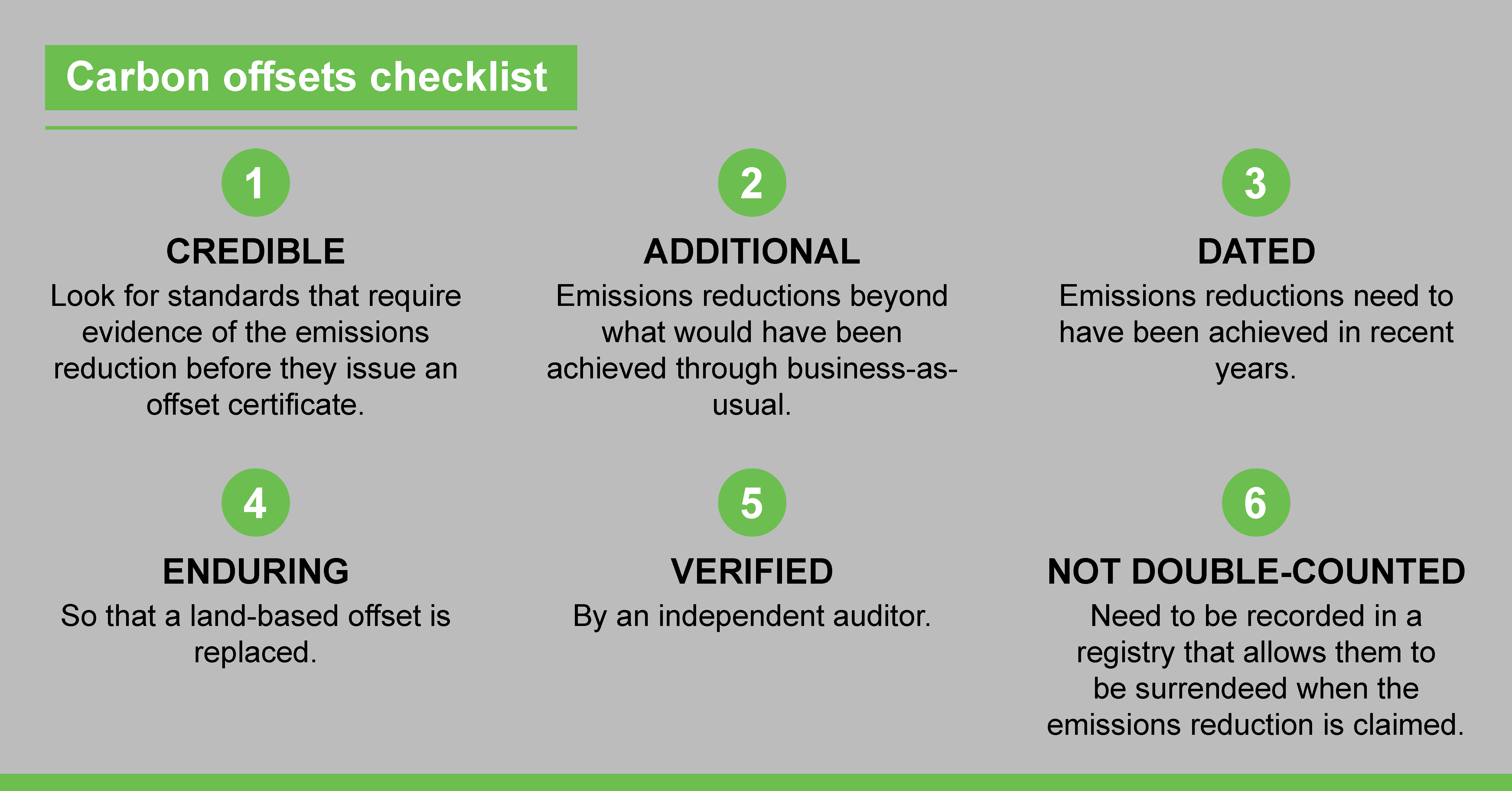

While the sector continues to mature, the selection of offsets becomes a question of risk tolerance and often a commercial trade-off between risk and cost. In this process, it’s important that key decision makers understand the primary purpose of offsets which is to allow emissions reductions to be transferred from one entity to another. Emissions reductions which are genuine (actually occurred) and additional (are more than would have occurred with business as usual) should be of paramount concern. Undertaking due diligence into the standard, method, and project (considering aspects such as additionality, credibility, vintage, permanence, transparently accounted for, and audited) will allow you to select quality offsets. Assessing reputation of counterparties and understanding risk sharing is particularly important in partnerships and for offset originators.

Purchasing ACCUs

The secondary market is the only way entities in Australia can buy ACCUs. It refers to over-the-counter trades which are made via a broker. Currently it is not a transparent market with easy price and volume discovery.

There are a number of reasons why the price in the secondary market for ACCUs is much higher than the Clean Energy Regulator’s average price. They include:

- Optional contracts now available through the ERF are increasingly being used to de-risk projects and may not reflect the market value

- A lot of the low cost, quick win abatement projects have already been exhausted

- There is increasing demand for ACCUs to meet voluntary commitments (carbon neutral claims or near-term net zero targets, for example)

- Scarcity, an illiquid market, and lack of real-time price and volume transparency means that ACCU sellers can be price setters

- Traders and speculators are increasingly entering the market, and because the market is illiquid, small changes in volume can produce large changes in price.

What can we expect into the future for offset markets?

Increasingly, we should see the following:

- A drive towards higher quality offsets as expectations rise and carbon markets mature

- Greater scrutiny of the types of offsets purchased to meet net zero targets and carbon neutral claims with associated reputational risk[2]

- Increased focus on the planned use of offsets to meet net zero targets with an expectation that offsets are reserved for genuinely hard-to-abate sources

- Stratification of offset projects by type. For example, emissions avoidance projects being considered less genuine, additionality being questioned for renewable energy projects, and a greater value placed on permanent emissions removals with low chance of reversal (such as mineral carbonation)

- Greater integration of global carbon markets as part of operationalising Article 6 of the Paris Agreement

- Price volatility particularly as supply and demand factors continue to be influenced by policy settings (both domestic and international), offset availability, and increasing voluntary demand.

Footnotes

[1] ABC | Insider blows whistle on Australia's greenhouse gas reduction schemes | 24 March 2022

[2] AFR | Westpac’s carbon neutrality a little smoky | 21 July 2021