Australia’s energy market is undergoing an unprecedented transformation. More and more organisations are committing to becoming a part of the clean energy transition by purchasing 100% renewable energy. By far the most common way to do this amongst large energy users is to enter into a corporate Power Purchase Agreement (PPA) with a renewable energy project(s) either directly or via a retailer. A range of PPA types and models have emerged in the market in recent years, but most can be broadly categorised into one of two categories: financial PPAs (also known as contracts for difference, CFDs) or supply-linked PPAs (also referred to as retailer intermediated). Each type carries its own suite of risks and benefits to the buyer and, as the PPA market matures, we have seen shifts in preferences for risk sharing. The corporate renewable contracting market has swung away from financial PPAs, towards retailer intermediated PPAs, as corporates seek to avoid the perceived risks of CFDs in their procurement strategies. However, are these perceptions founded in reality? How much is ‘hype’? In this article, we explore the pros and cons of the two types of PPA.

A large market shift

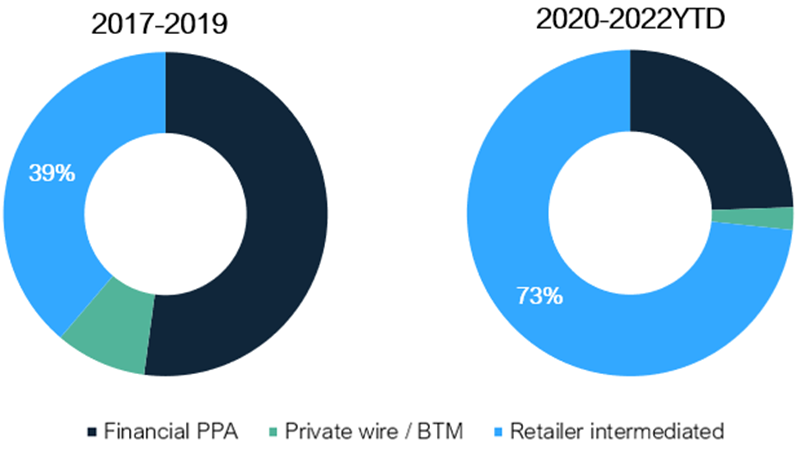

As outlined in the introduction, the Australian market has seen a rapid increase in retailer intermediated PPA offerings. These contract models enable buyers to pass much of the project performance and market price risks to the retailer[1]. Data from Energetics’ corporate renewable PPA tracker shows that while only 39%[2] of the contracted PPA volume (in GWh) announced between 2017-2019 was retailer intermediated, this figure increased to 73% for transactions announced in 2020-2022.

Figure 1: Change in the type of PPAs executed in the Australian market

Spot market exposure presents risks, but the financial upside could be significant

Financial PPAs can expose the buyer to significant market price risk and cashflow volatility over the life of the contract. Beyond this exposure, cashflow variability and operational complexity, as well as legal and accounting obligations may in themselves be significant enough to swing the pendulum towards retailer intermediated PPAs.

However, it is important to note that under a well-structured financial PPA, losses are generally limited to the strike price of the PPA, in the worst-case scenario[3]. The upside, on the other hand, is potentially uncapped, which can result in significant windfall-gains for buyers when power prices skyrocket. We saw this happen recently, when the market was driven up by coal plant outages and increased fuel costs.

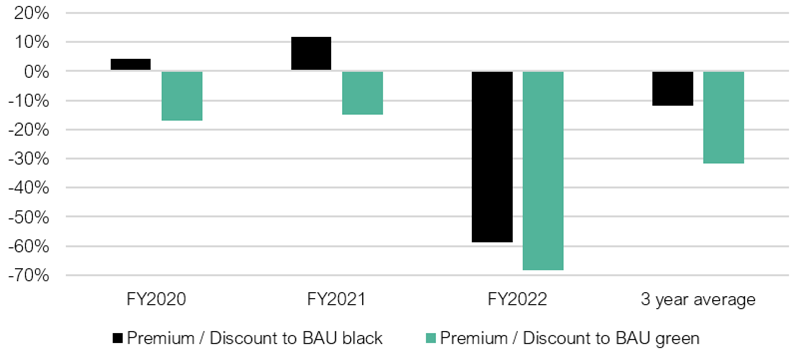

The value of a renewable financial PPA as an active electricity market hedge in volatile times has been well demonstrated over the FY2020 to FY2022 period where power prices have oscillated between historical lows and all-time highs. As illustrated in Figure 2 below, for a wind-backed financial PPA in NSW, a large customer with a competitively negotiated wind hedge would have received over a three year period, 100% renewable electricity at a discount of ~10% compared to standard black power, or ~30% compared to short term green power contracts.

Figure 2: Net electricity cost premium (discount) attributable to a financial PPA (illustrative for wind in NSW)[4]

Month to month cashflow variability associated with the PPA can, however, be significant, varying from a low of -$240,000 in February 2021 to a high of nearly +$2m in May 2022, for an approximate offtake of 80GWh pa. In fact, despite the overall positive financial outcome over the three years, 21 of the 36 months in this illustrative example, recorded negative settlement amounts.

Understand your appetite for risk and identify where opportunities lie

Financial PPAs have their merits, not the least of which is the ability to benefit in a rising market. Organisations would be well advised to give them some consideration when developing a long term electricity risk management strategy. The decision on inclusion of a financial PPA in the organisation’s energy procurement portfolio should be primarily driven by the organisation’s risk tolerance, and close attention must be paid to the relative risk exposure of other PPA products, including those offered by retailers as direct or indirect sleeving arrangements.

Energetics has provided commercial and contract design advice to the vast majority of PPAs secured over the past five years in the NEM. Key to that advice is our deep understanding of the energy markets and the drivers of risk – and opportunity. Please contact the author or any of our energy market experts for advice.

[1] See the “Retailer intermediated PPA pricing and volume management models” article for further detail

[2] By volume

[3] Assuming the contract includes a floor price of $0/MWh

[4] Black BAU refers to a standard electricity three year fixed price electricity supply contract which includes approximately 19% renewable electricity purchased as part of the renewable electricity target obligation imposed on retailers. BAU green includes the purchase of additional LGCs at prevailing market prices as at the start of each supply year.